Asked by Nicholas Malmquist on Apr 24, 2024

Verified

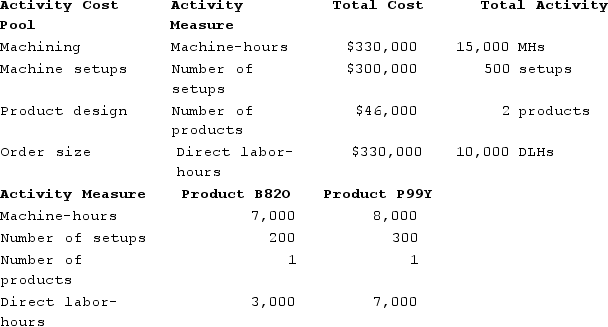

Immen Corporation manufactures two products: Product B82O and Product P99Y. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products B82O and P99Y.  Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

A) $704,200

B) $301,800

C) $610,000

D) $503,000

Plantwide Overhead Rate

A single overhead allocation rate used throughout a manufacturing plant or entire facility, applied uniformly to all products or cost centers.

Activity-based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the activities that generate costs.

- Inspect the impact that adopting an ABC system has on distributing manufacturing overhead costs across different products.

- Contrast the application of a plantwide overhead rate against activity-based costing techniques in the apportionment of overhead charges.

Verified Answer

TS

Thothadri Seshadri5 days ago

Final Answer :

B

Explanation :

To calculate the manufacturing overhead cost allocated to Product B82O using the plantwide overhead rate, we need to first calculate the total direct labor-hours for the company as a whole and for Product B82O.

Total Company Direct Labor-Hours:

50,000 + 20,000 + 30,000 + 40,000 = 140,000

Direct Labor-Hours for Product B82O:

20,000

Next, we can use the plantwide overhead rate to allocate overhead to Product B82O:

$1,510,000 / 140,000 labor-hours = $10.79 per labor-hour

20,000 labor-hours (for Product B82O) * $10.79 = $215,800

Therefore, the manufacturing overhead cost allocated to Product B82O using the plantwide overhead rate would be $215,800. Option B is the correct answer.

Total Company Direct Labor-Hours:

50,000 + 20,000 + 30,000 + 40,000 = 140,000

Direct Labor-Hours for Product B82O:

20,000

Next, we can use the plantwide overhead rate to allocate overhead to Product B82O:

$1,510,000 / 140,000 labor-hours = $10.79 per labor-hour

20,000 labor-hours (for Product B82O) * $10.79 = $215,800

Therefore, the manufacturing overhead cost allocated to Product B82O using the plantwide overhead rate would be $215,800. Option B is the correct answer.

Learning Objectives

- Inspect the impact that adopting an ABC system has on distributing manufacturing overhead costs across different products.

- Contrast the application of a plantwide overhead rate against activity-based costing techniques in the apportionment of overhead charges.