Asked by Le'Mina McNair on May 12, 2024

Verified

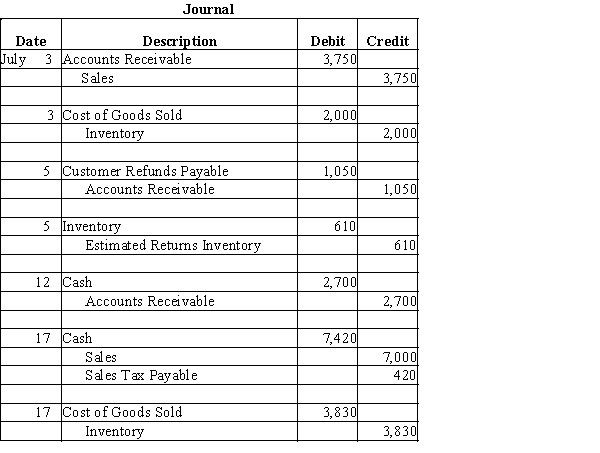

Journalize the following transactions assuming the perpetual inventory system:

July 3

Sold merchandise on account for $3,750 terms n/eom. The cost of the goods sold was $2,000.5

Issued credit memo for $1,050 for merchandise returned from sale on July 3.The cost of the merchandise returned was $610.12

Received check for the amount due for sale on July 3 less return on July 5.17

Sold merchandise for $7,000 plus 6% sales tax to cash customers. The cost of the goods sold was $3,830.

Perpetual Inventory System

A procedural method in inventory accounting that directly records every inventory sale or purchase with the aid of computerized point-of-sale systems and enterprise asset management software.

Sales Tax

A tax on sales or on the receipts from sales.

Credit Memo

A document issued by a seller to a buyer, reducing the amount owed, often due to a return or overcharge.

- Document diverse financial activities, including sales transactions, returns, and transportation fees, for both the buying and selling parties in an ongoing inventory system.

- Interpret and journalize transactions involving sales taxes, credit terms, and payment discounts.

Verified Answer

KB

Learning Objectives

- Document diverse financial activities, including sales transactions, returns, and transportation fees, for both the buying and selling parties in an ongoing inventory system.

- Interpret and journalize transactions involving sales taxes, credit terms, and payment discounts.