Asked by Barbara silva on May 20, 2024

Verified

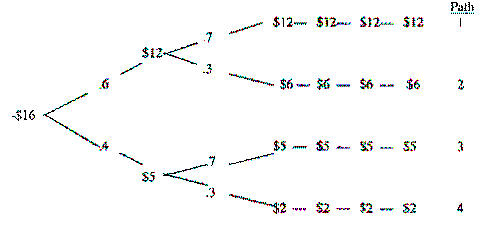

Kanick Corp is evaluating a new venture project and has developed the following decision tree analysis ($M).

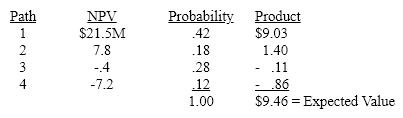

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Decision Tree Analysis

A graphical technique used for decision-making and risk management, representing different courses of action and their possible outcomes.

Cost Of Capital

The cost of capital represents the required return necessary to make a capital budgeting project, such as building a new factory, worthwhile.

Pure Play

A company that focuses exclusively on a single product or service area.

- Acquire an understanding of the importance of modifying for risk within capital budgeting and the implementation of correct discount rates.

- Realize the importance of decision options in capital budgeting, including the aspects of expansion, abandonment, and the timing of actions.

Verified Answer

CH

Carla HoustonMay 20, 2024

Final Answer :  The project has an expected NPV of over $9M, which argues for acceptance. However, the probability distribution shows a good chance (12%) of a loss exceeding $7M on a present value basis. Acceptance is likely to turn on whether the firm could survive a loss that large.

The project has an expected NPV of over $9M, which argues for acceptance. However, the probability distribution shows a good chance (12%) of a loss exceeding $7M on a present value basis. Acceptance is likely to turn on whether the firm could survive a loss that large.

The project has an expected NPV of over $9M, which argues for acceptance. However, the probability distribution shows a good chance (12%) of a loss exceeding $7M on a present value basis. Acceptance is likely to turn on whether the firm could survive a loss that large.

The project has an expected NPV of over $9M, which argues for acceptance. However, the probability distribution shows a good chance (12%) of a loss exceeding $7M on a present value basis. Acceptance is likely to turn on whether the firm could survive a loss that large.

Learning Objectives

- Acquire an understanding of the importance of modifying for risk within capital budgeting and the implementation of correct discount rates.

- Realize the importance of decision options in capital budgeting, including the aspects of expansion, abandonment, and the timing of actions.