Asked by Haktan Öztürkçü on May 22, 2024

Verified

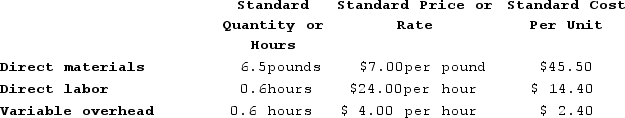

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for June is:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for June is:

A) $760 Favorable

B) $760 Unfavorable

C) $741 Favorable

D) $741 Unfavorable

Variable Overhead Efficiency Variance

The difference between the actual variable overhead incurred and the standard cost allocated for the actual production achieved.

- Compute the variances of efficiency and rate in variable overhead to assess the management of overhead costs.

Verified Answer

EH

Evariste HatungimanaMay 26, 2024

Final Answer :

B

Explanation :

Variable overhead efficiency variance is calculated as follows:

Variable overhead efficiency variance = (Actual hours worked - Standard hours allowed) x Variable overhead rate per hour

Standard hours allowed = Standard direct labor hours per unit x Actual output

Standard direct labor hours per unit = 0.5 hour per unit

Actual output = 3,500 units

Standard hours allowed = 0.5 hour per unit x 3,500 units = 1,750 hours

Variable overhead rate per hour = Actual variable overhead costs ÷ Actual direct labor hours

Variable overhead rate per hour = $8,931 ÷ 2,290 hours = $3.90 per hour

Actual hours worked = 2,290 hours

Variable overhead efficiency variance = (2,290 hours - 1,750 hours) x $3.90 per hour

= $1,711 Unfavorable

Therefore, the answer is B.

Variable overhead efficiency variance = (Actual hours worked - Standard hours allowed) x Variable overhead rate per hour

Standard hours allowed = Standard direct labor hours per unit x Actual output

Standard direct labor hours per unit = 0.5 hour per unit

Actual output = 3,500 units

Standard hours allowed = 0.5 hour per unit x 3,500 units = 1,750 hours

Variable overhead rate per hour = Actual variable overhead costs ÷ Actual direct labor hours

Variable overhead rate per hour = $8,931 ÷ 2,290 hours = $3.90 per hour

Actual hours worked = 2,290 hours

Variable overhead efficiency variance = (2,290 hours - 1,750 hours) x $3.90 per hour

= $1,711 Unfavorable

Therefore, the answer is B.

Learning Objectives

- Compute the variances of efficiency and rate in variable overhead to assess the management of overhead costs.

Related questions

Miguez Corporation Makes a Product with the Following Standard Costs ...

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Miguez Corporation Makes a Product with the Following Standard Costs ...

The Following Data Have Been Provided by Furr Corporation ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...