Asked by Brycen Cluster on Jul 05, 2024

Verified

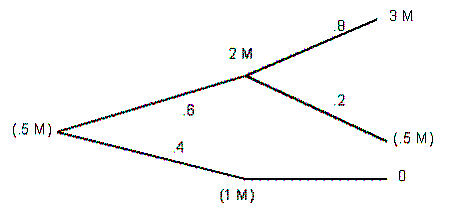

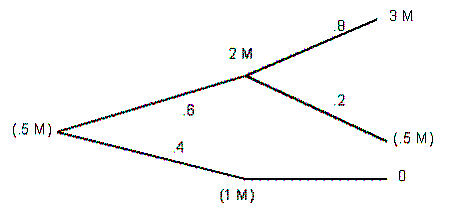

Komarek Forests is considering a new software package that may improve productivity over the next two years. There is a sixty percent chance that the project will be a success in Year 1, earning $2 million and a forty percent change that the venture will fail during the first year resulting in a $1 million loss due to worse asset management than under the current system. The original system would be reinstalled, resulting in no additional losses during the second year. If the project is a success in the first year, there is an eighty percent chance that it will earn $3 million in the second year. There is a twenty percent chance that the software will be ineffective in Year 2, despite success in Year 1, in which case there would be a loss of $500,000. Assuming a nine percent required rate of return on these, and a total cost of the software system of $500,000, should Komarek install the new system?

Asset Management

The systematic process of developing, operating, maintaining, and selling assets in a cost-effective manner.

Required Rate Of Return

The minimum return an investor expects to achieve on an investment, taking into account its risk level.

Productivity

Productivity is a measure of the efficiency of production, often expressed as the ratio of output to input in the production of goods and services.

- Ascertain and interpret the NPV of different projects by leveraging probability forecasts in diverse scenarios.

Verified Answer

TA

Taryn AshleighJul 11, 2024

Final Answer :  Path 1: Probability: 0.6 × 0.8 = 0.48

Path 1: Probability: 0.6 × 0.8 = 0.48

CF0 = -500,000 CF1 = $2,000,000 CF2 = $3,000,000 I = 9 Solve for NPV = $3,859,902

Path 2: Probability: 0.6 × 0.2 = 0.12

CF0 = -500,000 CF1 = $2,000,000 CF2 = -$500,000 I = 9 Solve for NPV = $914,022

Path 3: Probability: 0.4

CF0 = -500,000 CF1 = -1,000,000 I = 9 Solve for NPV = -$1,417,431

Expected Value = .48 ($3,859,902) + .12 ($914,022) + 0.4 (-$1,417,431)

$1,852,753 + $109,683 - $566,972 = $1,395,464

The present value of the project is a positive $1,395,464. However, there is forty percent chance of losing $1,417,431. Komarek Forests may conclude that the chance of loss is too great, and forego this positive NPV project.

Path 1: Probability: 0.6 × 0.8 = 0.48

Path 1: Probability: 0.6 × 0.8 = 0.48 CF0 = -500,000 CF1 = $2,000,000 CF2 = $3,000,000 I = 9 Solve for NPV = $3,859,902

Path 2: Probability: 0.6 × 0.2 = 0.12

CF0 = -500,000 CF1 = $2,000,000 CF2 = -$500,000 I = 9 Solve for NPV = $914,022

Path 3: Probability: 0.4

CF0 = -500,000 CF1 = -1,000,000 I = 9 Solve for NPV = -$1,417,431

Expected Value = .48 ($3,859,902) + .12 ($914,022) + 0.4 (-$1,417,431)

$1,852,753 + $109,683 - $566,972 = $1,395,464

The present value of the project is a positive $1,395,464. However, there is forty percent chance of losing $1,417,431. Komarek Forests may conclude that the chance of loss is too great, and forego this positive NPV project.

Learning Objectives

- Ascertain and interpret the NPV of different projects by leveraging probability forecasts in diverse scenarios.