Asked by ESTELA LUCCHESI on Jul 17, 2024

Verified

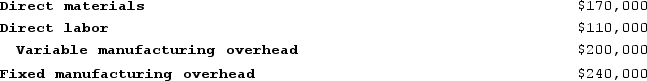

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:  Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.Under absorption costing, the ending inventory for the year would be valued at:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.Under absorption costing, the ending inventory for the year would be valued at:

A) $0

B) $216,000

C) $248,250

D) $180,000

Absorption Costing

In this accounting procedure, the full scope of manufacturing costs, covering direct materials, direct labor, and both kinds of manufacturing overhead—variable and fixed—is accounted for in the product's pricing.

Ending Inventory

The total value of goods available for sale at the end of an accounting period.

- Ascertain the value of closing inventory by employing both absorption and variable costing approaches.

Verified Answer

MH

Maisyarah HawafiJul 18, 2024

Final Answer :

D

Explanation :

Under absorption costing, the ending inventory includes both variable and fixed manufacturing costs. The total manufacturing cost per unit is $47 ($9 + $20 + $18) per unit. Therefore, the total cost of producing all 20,000 units is $940,000. The cost of goods sold is $660,000 ($44 x 15,000 units sold). The ending inventory is the cost of the remaining 5,000 units, which is $280,000 ($47 x 5,000 units). However, we need to subtract the fixed manufacturing overhead from the ending inventory since it is not expensed until the units are sold. The fixed manufacturing overhead rate is $4.50 per unit ($90,000 / 20,000 units). Therefore, the ending inventory valued under absorption costing is $180,000 ($280,000 – ($4.50 x 5,000 units)).

Learning Objectives

- Ascertain the value of closing inventory by employing both absorption and variable costing approaches.

Related questions

The Value of the Company's Inventory on November 30 Under ...

Home Base,Inc.reports the Following Production Cost Information ...

Lukin Corporation Reports the Following First Year Production Cost Information ...

Castaway Company Reports the Following First Year Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...