Asked by Jasmine Hawkins on May 18, 2024

Verified

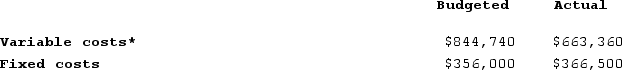

Leslie Company operates a cafeteria for the benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual costs in the cafeteria for the year just ended are as follows:

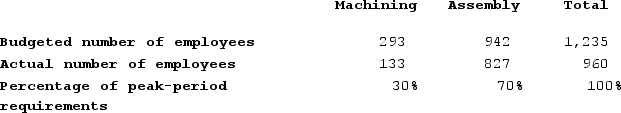

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

Required:a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b.Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Required:a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b.Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Producing Departments

Departments or divisions within an organization directly involved in producing the goods or services offered to customers.

Fixed Costs

Costs that do not change with the level of production or sales activity within a certain range and period, such as rent, salaries, and insurance.

Cafeteria

A type of food service location within an institution where customers serve themselves from a variety of dishes made available.

- Determine the effect of fluctuating and fixed costs in the calculation of internal transfer prices and charges assigned to divisions.

- Strengthen the ability to report financially to internal divisions, paying special attention to the apportionment of costs and responsibility accounting procedures.

Verified Answer

Variable costs are charged at the budgeted rate of ${{[v(11)]:#,###}} per employee. Fixed costs are charged in predetermined lump-sum amounts.

![a.Budgeted rate per employee: ${{[v(1)]:#,###}} ÷ {{[v(7)]:#,###}} = ${{[v(11)]:#,###}} Variable costs are charged at the budgeted rate of ${{[v(11)]:#,###}} per employee. Fixed costs are charged in predetermined lump-sum amounts. b.The remaining amounts of variable and fixed costs are variances that should not be charged:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_633c_db98_bf83_ab14f765fc1b_TB8314_00.jpg) b.The remaining amounts of variable and fixed costs are variances that should not be charged:

b.The remaining amounts of variable and fixed costs are variances that should not be charged:![a.Budgeted rate per employee: ${{[v(1)]:#,###}} ÷ {{[v(7)]:#,###}} = ${{[v(11)]:#,###}} Variable costs are charged at the budgeted rate of ${{[v(11)]:#,###}} per employee. Fixed costs are charged in predetermined lump-sum amounts. b.The remaining amounts of variable and fixed costs are variances that should not be charged:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_633c_db99_bf83_9917c767a93d_TB8314_00.jpg)

Learning Objectives

- Determine the effect of fluctuating and fixed costs in the calculation of internal transfer prices and charges assigned to divisions.

- Strengthen the ability to report financially to internal divisions, paying special attention to the apportionment of costs and responsibility accounting procedures.

Related questions

Sauseda Corporation Has Two Operating Divisions-An Inland Division and a ...

Leslie Company Operates a Cafeteria for the Benefit of Its ...

Cannata Corporation Has Two Operating Divisions--A North Division and a ...

Sauseda Corporation Has Two Operating Divisions--An Inland Division and a ...

Shular Products, Incorporated, Has a Valve Division That Manufactures and ...