Asked by Vanessa Rodriguez on Apr 24, 2024

Verified

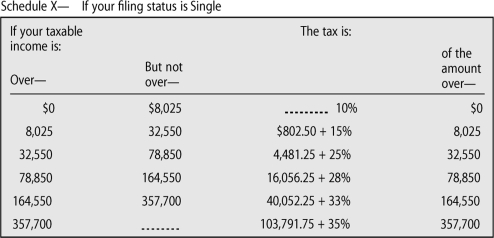

Lisa is a single taxpayer whose total income before deductions is $57,392.She was able to reduce her total income by $9,347 by filing Schedule A.Use the tax rate schedule below.How much did she save using Schedule A?

Schedule A

A form used in the United States tax system for itemizing allowable deductions against personal income to reduce taxable income.

Tax Rate Schedule

A chart or table that determines the amount of tax due based on income brackets, applicable to different filing statuses.

Total Income

The aggregate amount of income earned by an individual or entity from all sources before any deductions or taxes.

- Determine tax savings through itemized deductions using the tax rate schedule.

Verified Answer

MB

Learning Objectives

- Determine tax savings through itemized deductions using the tax rate schedule.