Asked by Aliyana Shivji on Jul 24, 2024

Verified

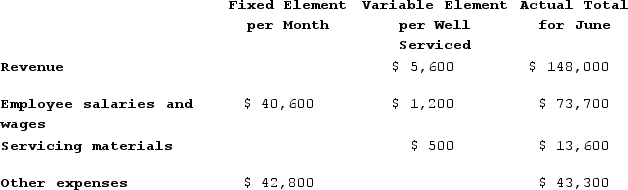

Lochner Corporation is an oil well service company that measures its output by the number of wells serviced. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for June.  When the company prepared its planning budget at the beginning of June, it assumed that 24 wells would have been serviced. However, 26 wells were actually serviced during June.The activity variance for revenue for June would have been closest to:

When the company prepared its planning budget at the beginning of June, it assumed that 24 wells would have been serviced. However, 26 wells were actually serviced during June.The activity variance for revenue for June would have been closest to:

A) $13,600 U

B) $13,600 F

C) $11,200 F

D) $11,200 U

Wells Serviced

The number of oil or gas wells that have undergone maintenance, repair, or other services by a company.

Revenue Variance

The difference between the actual revenue earned and the expected or budgeted revenue.

Fixed Costs

Expenses that do not change in proportion to the activity of a business, such as rent, salaries, and insurance.

- Employ comprehension of constant and fluctuating costs to anticipate financial performance.

- Evaluate and determine the differences in earnings related to service provisions.

Verified Answer

EA

Elizabeth AntonyJul 27, 2024

Final Answer :

C

Explanation :

To find the activity variance for revenue, we need to use the following formula:

Activity Variance = (Actual Level of Activity - Budgeted Level of Activity) * Budgeted Unit Contribution Margin

Budgeted Unit Contribution Margin = Selling Price - Variable Cost per Unit = $1,200 - $800 = $400

Actual Level of Activity = 26

Budgeted Level of Activity = 24

Budgeted Unit Contribution Margin = $400

Activity Variance for Revenue = (26 - 24) * $400 = $800 F

Therefore, the closest option is C) $11,200 F.

Activity Variance = (Actual Level of Activity - Budgeted Level of Activity) * Budgeted Unit Contribution Margin

Budgeted Unit Contribution Margin = Selling Price - Variable Cost per Unit = $1,200 - $800 = $400

Actual Level of Activity = 26

Budgeted Level of Activity = 24

Budgeted Unit Contribution Margin = $400

Activity Variance for Revenue = (26 - 24) * $400 = $800 F

Therefore, the closest option is C) $11,200 F.

Learning Objectives

- Employ comprehension of constant and fluctuating costs to anticipate financial performance.

- Evaluate and determine the differences in earnings related to service provisions.

Related questions

Which of the Following Is the Correct Formula for the ...

To Help Assess How Well a Manager Has Controlled Costs ...

If Activity Is Higher Than Expected, Total Fixed Costs Should ...

Variable Costs Are Always Relevant Costs in Decisions

The Financing of Short-Term Assets with Short-Term Debt Is Known ...