Asked by Jaden knight on May 15, 2024

Verified

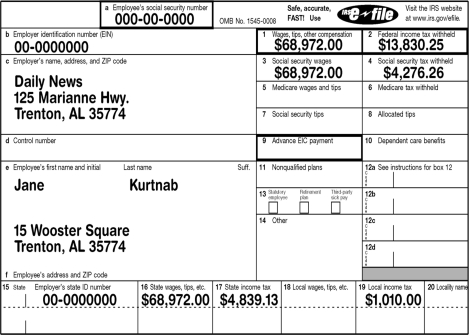

Look at the W-2 below.What is the total amount of federal,state,and local taxes that were withheld?

A) $13,830.25

B) $18,669.38

C) $19,679.38

D) $23,955.64

W-2

A form used in the United States to report wages paid to employees and the taxes withheld from them.

Federal Taxes

Federal taxes are financial charges imposed by the national government on income, business profits, sales, and other forms of economic activity.

State Taxes

State taxes are financial charges imposed by individual states on income, property, sales, and other activities, varying widely between different states.

- Identify the role and contents of essential tax documents such as W-2, 1040, and 1099 forms.

Verified Answer

DH

DANNI HUANGMay 20, 2024

Final Answer :

C

Explanation :

We need to add up the federal, state, and local taxes withheld. From the W-2, we can see that:

- Federal income tax withheld: $9,452.00

- State income tax withheld: $3,733.50

- Local income tax withheld: $493.88

Adding these up, we get:

$9,452.00 + $3,733.50 + $493.88 = $13,679.38

Therefore, the correct answer is C) $19,679.38.

- Federal income tax withheld: $9,452.00

- State income tax withheld: $3,733.50

- Local income tax withheld: $493.88

Adding these up, we get:

$9,452.00 + $3,733.50 + $493.88 = $13,679.38

Therefore, the correct answer is C) $19,679.38.

Learning Objectives

- Identify the role and contents of essential tax documents such as W-2, 1040, and 1099 forms.