Asked by Quitta Moore on Apr 28, 2024

Verified

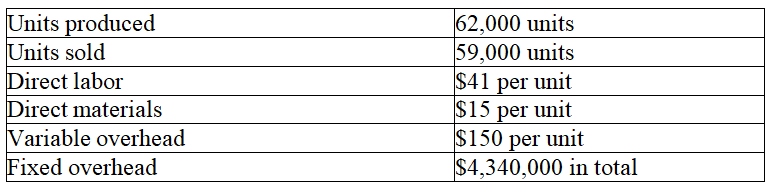

Lukin Corporation reports the following first year production cost information.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

Variable Costing

An accounting method that only considers variable costs (costs that fluctuate with production levels) in the calculation of product cost.

Absorption Costing

A costing approach that encompasses all costs associated with production, including direct materials, direct labor, and all overhead costs, both variable and fixed, in the unit cost of a product.

Ending Inventory

The total value of all unsold goods a company has at the end of an accounting period.

- Determine unit production costs and end-of-period inventory expenses using variable and absorption costing approaches.

Verified Answer

b.$206 + ($4,340,000/62,000)FOH = $276 per unit under absorption costing

c.(62,000 units - 59,000 units)× $206 per unit = $618,000 ending inventory under variable costing

d.(62,000 units - 59,000 units)× $276 per unit = $828,000 ending inventory under absorption costing

Learning Objectives

- Determine unit production costs and end-of-period inventory expenses using variable and absorption costing approaches.

Related questions

Lukin Corporation Reports the Following First Year Production Cost Information ...

A Company Reports the Following Information Regarding Its Production Cost ...

A Company Reports the Following Information Regarding Its Production Cost ...

Castaway Company Reports the Following First Year Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...