Asked by James Copper on Jun 11, 2024

Verified

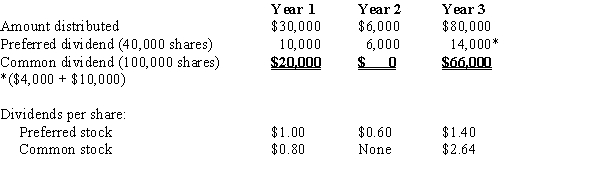

Macy Company has 10,000 shares of 2% cumulative preferred stock of $50 par and 25,000 shares of $75 par common stock. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Preferred Stock

A category of corporate ownership that has a priority over common stock in terms of asset and earnings claims, typically offering fixed dividend payments.

Common Stock

A type of equity security that represents ownership in a corporation, giving holders voting rights and a share in the company's profits via dividends.

Dividends

Distributions from a company to its shareholders, usually coming from the firm's earnings.

- Master the techniques for calculating dividends per share for preferred and common stocks in a range of different situations.

Verified Answer

EM

Learning Objectives

- Master the techniques for calculating dividends per share for preferred and common stocks in a range of different situations.