Asked by ashaunte wellington on Jul 27, 2024

Verified

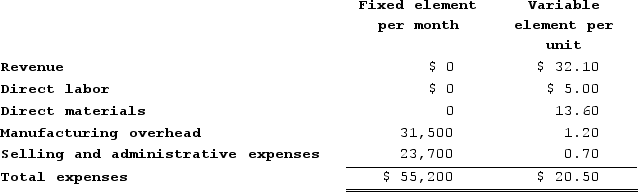

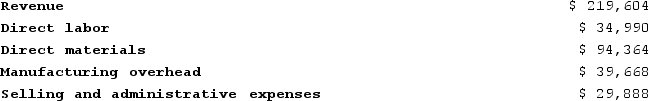

Manter Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During June, the company budgeted for 6,900 units, but its actual level of activity was 6,940 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June:Data used in budgeting:  Actual results for June:

Actual results for June:

The spending variance for direct materials in June would be closest to:

The spending variance for direct materials in June would be closest to:

A) $524 F

B) $20 F

C) $20 U

D) $524 U

Units

A measurement of quantity, used in various contexts to indicate the amount, volume, or number of items or elements.

Spending Variance

The variance between the anticipated budget for an expense and the actual expenditure.

Direct Materials

Raw materials that are directly used in the manufacturing of a product and are easily traceable to that product.

- Examine the distinctions between a range of variances, such as spending, activity, and overall financial revenue and expenditure discrepancies.

Verified Answer

Expected cost of direct materials = Budgeted rate x Actual activity level

Budgeted rate = $6 per pound of direct materials

Actual activity level = 6,940 units x 3 pounds per unit = 20,820 pounds

Expected cost of direct materials = $6 x 20,820 pounds = $124,920

Actual cost of direct materials used = $123,440

Spending variance = Expected cost - Actual cost

Spending variance = $124,920 - $123,440 = $1,480 F

Therefore, the closest answer is B) $20 F, which is off by $1,460 due to rounding.

Learning Objectives

- Examine the distinctions between a range of variances, such as spending, activity, and overall financial revenue and expenditure discrepancies.

Related questions

Moncrief Corporation Bases Its Budgets on Machine-Hours ...

Lightsey Natural Dying Corporation Measures Its Activity in Terms of ...

At Jacobson Company, Indirect Labor Is a Variable Cost That ...

Tos Corporation's Flexible Budget Cost Formula for Indirect Materials, a ...

Ramkissoon Midwifery's Cost Formula for Its Wages and Salaries Is ...