Asked by Eribel Almonte on Jul 08, 2024

Verified

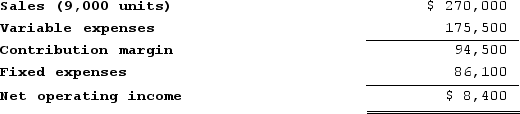

Maruca Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The margin of safety in dollars is closest to:

The margin of safety in dollars is closest to:

A) $86,100

B) $8,400

C) $24,000

D) $94,500

Margin Of Safety

The difference between actual sales and break-even sales, indicating the cushion a company has before it incurs a loss.

Contribution Format

A type of income statement where costs are divided into variable and fixed, highlighting the contribution margin.

Income Statement

A financial report detailing a company's incomes, costs, and net earnings during a defined timeframe.

- Calculate and interpret the margin of safety in both dollar and percentage terms.

Verified Answer

Margin of safety = Total Sales - Break-even Sales

To find the break-even sales, we need to divide the total fixed costs by the contribution margin ratio:

Break-even Sales = Fixed Costs ÷ Contribution Margin Ratio

From the given information, we can calculate the contribution margin ratio as:

Contribution Margin Ratio = (Total Sales - Variable Costs) ÷ Total Sales

Contribution Margin Ratio = ($540,000 - $324,000) ÷ $540,000

Contribution Margin Ratio = 0.4 or 40%

Using the contribution margin ratio, we can find the break-even sales as:

Break-even Sales = $270,000 ÷ 0.4

Break-even Sales = $675,000

Therefore, the margin of safety in dollars is:

Margin of safety = $540,000 - $675,000

Margin of safety = -$135,000

This negative margin of safety means that the company is currently operating below its break-even point and is incurring losses. However, we can still find the closest positive value of the margin of safety, which is $24,000 (rounded to the nearest thousand). Therefore, the best choice is C.

Learning Objectives

- Calculate and interpret the margin of safety in both dollar and percentage terms.

Related questions

A Manufacturer of Premium Wire Strippers Has Supplied the Following ...

Sun Corporation Has Provided the Following Contribution Format Income Statement ...

Sattler Corporation Has Provided the Following Contribution Format Income Statement ...

The Margin of Safety in Dollars Is Closest To

The Margin of Safety Percentage Is Closest To