Asked by James O'Connor on May 28, 2024

Verified

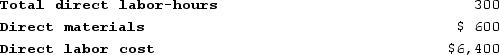

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 45,000 direct labor-hours, total fixed manufacturing overhead cost of $315,000, and a variable manufacturing overhead rate of $3.80 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.)

Variable Manufacturing Overhead

Costs that vary with manufacturing output, including items like indirect materials and utilities required for production processes.

Direct Labor-Hours

The total hours of labor directly involved in producing goods or services, which is often used as a base for allocating overhead costs.

- Ascertain the selling amount for specific duties factoring in a markup percentage.

Verified Answer

ZK

Zybrea KnightJun 03, 2024

Final Answer :

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8c_bf83_9b131bfe03f4_TB8314_00.jpg)

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8d_bf83_9ba51eb1d151_TB8314_00.jpg)

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8e_bf83_c509dc22c9f6_TB8314_00.jpg)

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8c_bf83_9b131bfe03f4_TB8314_00.jpg)

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8d_bf83_9ba51eb1d151_TB8314_00.jpg)

![Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = ${{[a(2)]:#,###}} + (${{[a(3)]:#,###.00}} per direct labor-hour × {{[a(1)]:#,###}} direct labor-hours) = ${{[a(2)]:#,###}} + ${{[a(16)]:#,###}} = ${{[a(9)]:#,###}}Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = ${{[a(9)]:#,###}} ÷ {{[a(1)]:#,###}} direct labor-hours = ${{[a(10)]:#,###.00}} per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = ${{[a(10)]:#,###.00}} per direct labor-hour × {{[a(5)]:#,###}} direct labor-hours = ${{[a(11)]:#,###}}](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_6220_bc8e_bf83_c509dc22c9f6_TB8314_00.jpg)

Learning Objectives

- Ascertain the selling amount for specific duties factoring in a markup percentage.

Related questions

Pasko Corporation Uses a Job-Order Costing System with a Single ...

Amason Corporation Has Two Production Departments, Forming and Assembly ...

The Markup Percent Is Based on Selling Price ...

Clark Thomas Wants to Purchase a Side Table for His ...

Neale Burgraaf Wants to Purchase a Halogen Lamp for Her ...