Asked by Jamesetta Quiteh on Jul 24, 2024

Verified

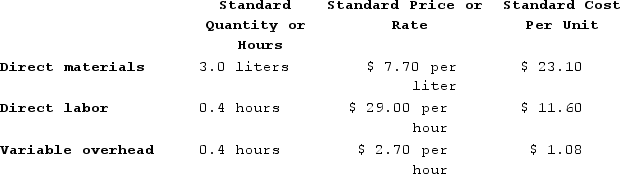

Miguez Corporation makes a product with the following standard costs:  The company budgeted for production of 3,300 units in September, but actual production was 3,200 units. The company used 6,140 liters of direct material and 1,750 direct labor-hours to produce this output. The company purchased 6,500 liters of the direct material at $7.90 per liter. The actual direct labor rate was $31.10 per hour and the actual variable overhead rate was $2.60 per hour.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for September is:

The company budgeted for production of 3,300 units in September, but actual production was 3,200 units. The company used 6,140 liters of direct material and 1,750 direct labor-hours to produce this output. The company purchased 6,500 liters of the direct material at $7.90 per liter. The actual direct labor rate was $31.10 per hour and the actual variable overhead rate was $2.60 per hour.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for September is:

A) $128 Favorable

B) $175 Unfavorable

C) $175 Favorable

D) $128 Unfavorable

Variable Overhead Rate Variance

Variable overhead rate variance is the difference between the actual variable overhead costs incurred and the expected (standard) costs, influenced by fluctuations in production activity levels.

- Assess variable overhead by calculating efficiency and rate variances to scrutinize overhead expense management.

Verified Answer

RJ

Ryan James BayerJul 30, 2024

Final Answer :

C

Explanation :

To calculate the variable overhead rate variance, we need to compare the actual variable overhead rate per hour to the standard variable overhead rate per hour, and then multiply the difference by the actual number of hours worked.

Standard variable overhead rate per hour = $1.80 (given)

Actual variable overhead rate per hour = $2.60 (given)

Actual hours worked = 1,750

Variable overhead rate variance = (Actual variable overhead rate per hour - Standard variable overhead rate per hour) x Actual hours worked

= ($2.60 - $1.80) x 1,750

= $875 Favorable

Therefore, the variable overhead rate variance for September is $875 Favorable, which means that the actual variable overhead rate per hour was higher than the standard variable overhead rate per hour, but the company used fewer direct labor-hours than expected, resulting in a favorable variance. Option C is the correct answer.

Standard variable overhead rate per hour = $1.80 (given)

Actual variable overhead rate per hour = $2.60 (given)

Actual hours worked = 1,750

Variable overhead rate variance = (Actual variable overhead rate per hour - Standard variable overhead rate per hour) x Actual hours worked

= ($2.60 - $1.80) x 1,750

= $875 Favorable

Therefore, the variable overhead rate variance for September is $875 Favorable, which means that the actual variable overhead rate per hour was higher than the standard variable overhead rate per hour, but the company used fewer direct labor-hours than expected, resulting in a favorable variance. Option C is the correct answer.

Learning Objectives

- Assess variable overhead by calculating efficiency and rate variances to scrutinize overhead expense management.

Related questions

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Miguez Corporation Makes a Product with the Following Standard Costs ...

Kartman Corporation Makes a Product with the Following Standard Costs ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...

The Following Data Have Been Provided by Furr Corporation ...