Asked by Ahmed Rashik on Apr 29, 2024

Verified

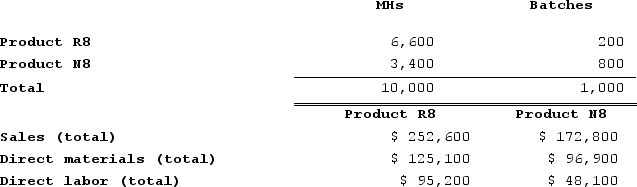

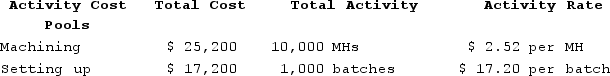

Neas Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $25,200 for the Machining cost pool, $17,200 for the Setting Up cost pool, and $41,600 for the Other cost pool.Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Activity-Based Costing

A costing methodology that assigns costs to products or services based on the activities and resources required to produce or deliver them.

Activity Cost Pools

A technique in managerial accounting where costs are aggregated based upon the activities that generate those costs, to assign costs more accurately.

Machine-Hours

A measure of production activity that quantifies the amount of time machinery is used to manufacture products during a specific period.

- Obtain a grasp on the principles of Activity-Based Costing (ABC).

- Derive the activity rates for a range of cost pools in an ABC environment.

- Distribute indirect charges among products through calculated activity rates.

Verified Answer

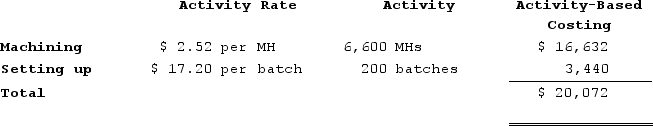

b.Assign overhead costs to products:Overhead cost for Product R8:

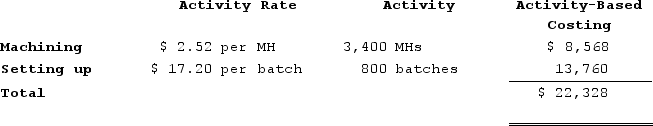

b.Assign overhead costs to products:Overhead cost for Product R8: Overhead cost for Product N8:

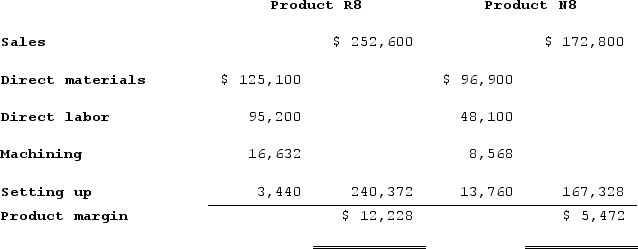

Overhead cost for Product N8: c.Determine product margins:

c.Determine product margins:

Learning Objectives

- Obtain a grasp on the principles of Activity-Based Costing (ABC).

- Derive the activity rates for a range of cost pools in an ABC environment.

- Distribute indirect charges among products through calculated activity rates.

Related questions

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...