Asked by GRETE ELISE WAGNER PAR on Jun 26, 2024

Verified

Norton Company is considering a closed-loop geothermal heat pump to replace its existing heating system. The project will require an initial investment of $750,000 and will return $200,000 each year for five years.

(a) If taxes are ignored and the required rate of return is 9%, what is the project's net present value?

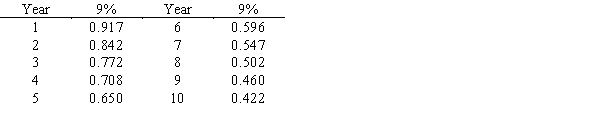

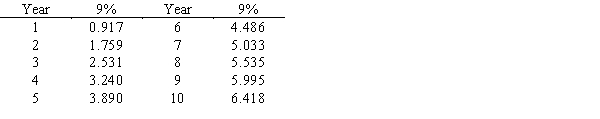

(b) Based on this analysis, should Norton Company proceed with the project?Below is a table for the present value of $1 at compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Geothermal Heat Pump

A central heating and/or cooling system that transfers heat to or from the ground, using the earth as a heat source or sink.

Net Present Value

A financial metric that estimates the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows over a period of time.

Compound Interest

Interest calculated on the initial principal and also on the accumulated interest from previous periods.

- Ascertain and evaluate the net present value (NPV) of investment suggestions.

- Evaluate investment plans by utilizing the internal rate of return (IRR) approach.

Verified Answer

BY

basant yadavJul 03, 2024

Final Answer :

(a)

($200,000 × 3.890) - $750,000 = $28,000

(b) Yes, since the net present value is greater than zero, Norton Company should proceed with the project.

(a)

($200,000 × 3.890) - $750,000 = $28,000

(b) Yes, since the net present value is greater than zero, Norton Company should proceed with the project.

Learning Objectives

- Ascertain and evaluate the net present value (NPV) of investment suggestions.

- Evaluate investment plans by utilizing the internal rate of return (IRR) approach.