Asked by Laura Arrunada on Jun 25, 2024

Verified

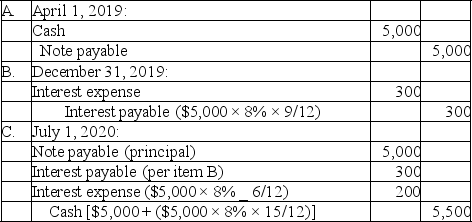

On April 1,2019,Wolf Company borrowed $5,000 on an 8% note payable.The maturity date of the note (and payment of all interest)is July 1,2020.The accounting period ends December 31.Assume no adjusting entries are made during the year.

Prepare the journal entry for each of the following dates:

A.April 1,2019.

B.December 31,2019.

C.July 1,2020.

Note Payable

A formal written agreement to pay a specific sum of money at a future date, representing a liability for the borrower.

Maturity Date

The Maturity Date refers to the specified date on which the principal amount of a financial instrument, such as a bond or loan, is due to be repaid.

Journal Entry

A record in the financial ledgers of a company reflecting a business transaction, involving a debit and credit in accordance to double-entry bookkeeping.

- Apprehend the essential concepts of registering financial operations concerning long-term debts and their implications for balance statements.

- Determine the cost of interest and recognize its implications for financial reports.

Verified Answer

Learning Objectives

- Apprehend the essential concepts of registering financial operations concerning long-term debts and their implications for balance statements.

- Determine the cost of interest and recognize its implications for financial reports.

Related questions

The Following Is a Partial List of Account Balances for ...

On January 1,2019,Alden Will Record a Note Payable in the ...

The Liability Reported on the Balance Sheet as of the ...

Which of the Following Operating Activities Is Not Correctly Matched ...

Assume That the Appropriate Adjusting Entry Was Made on December ...