Asked by Alaysia Mcnill on May 13, 2024

Verified

On January 1, 2010, Buster, Inc.bought $50, 000 of 10% ten-year bonds of Brown Co.for $56, 795 to yield 8% annually.The bonds pay interest semiannually and are classified as held to maturity.Interest is paid on June 30 and December 31.

Required:

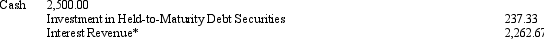

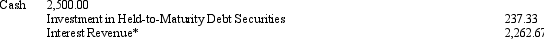

Using the effective interest method, journalize the receipt of the interest and amortization at December 31, 2010.

Effective Interest Method

An accounting method for amortizing bond premiums or discounts that results in a constant rate of interest over the life of the bond.

Semiannually

Refers to an event or action that occurs twice a year.

Held To Maturity

Refers to debt securities that an investor intends and has the ability to hold until they mature, as opposed to selling before maturity.

- Master the effective interest method for bond investments and understand the recognition of interest income and amortization.

Verified Answer

NP

Natalie PostonMay 19, 2024

Final Answer :

*

0.04′$56,795=$2,271.80$2,500.00−$2,271.80=$228.20$56,795−$228.20=$56,566.800.04′$56.566.80=$2.262.67\begin{array}{ll}0.04 ^\prime \$ 56,795 & =\$ 2,271.80 \\\$ 2,500.00-\$ 2,271.80 & =\$ 228.20 \\\$ 56,795-\$ 228.20 & =\$ 56,566.80 \\0.04^\prime \$ 56.566 .80 & =\$ 2.262 .67\end{array}0.04′$56,795$2,500.00−$2,271.80$56,795−$228.200.04′$56.566.80=$2,271.80=$228.20=$56,566.80=$2.262.67

*

0.04′$56,795=$2,271.80$2,500.00−$2,271.80=$228.20$56,795−$228.20=$56,566.800.04′$56.566.80=$2.262.67\begin{array}{ll}0.04 ^\prime \$ 56,795 & =\$ 2,271.80 \\\$ 2,500.00-\$ 2,271.80 & =\$ 228.20 \\\$ 56,795-\$ 228.20 & =\$ 56,566.80 \\0.04^\prime \$ 56.566 .80 & =\$ 2.262 .67\end{array}0.04′$56,795$2,500.00−$2,271.80$56,795−$228.200.04′$56.566.80=$2,271.80=$228.20=$56,566.80=$2.262.67

Learning Objectives

- Master the effective interest method for bond investments and understand the recognition of interest income and amortization.