Asked by Kimberly Valencia-Franco on Jul 01, 2024

Verified

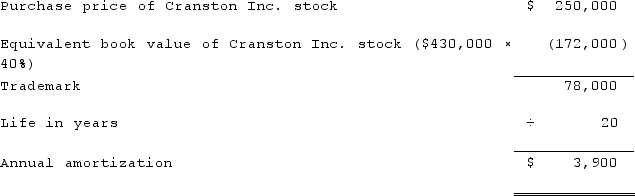

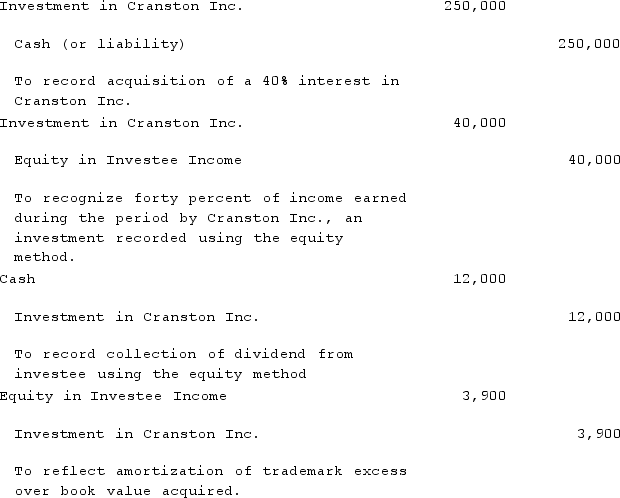

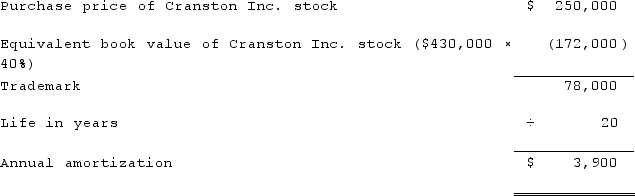

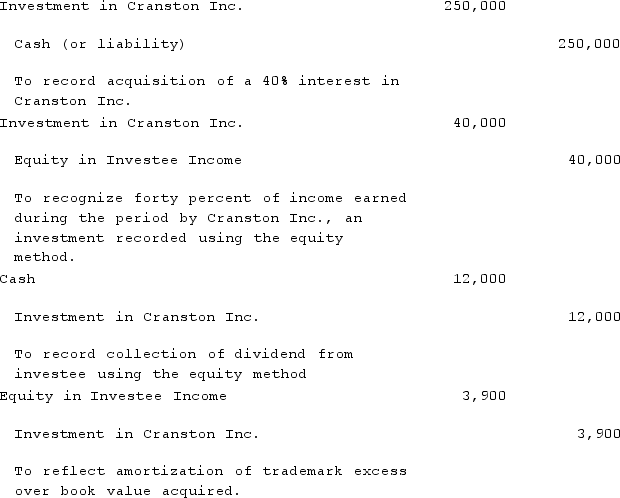

On January 1, 2021, Spark Corp. acquired a 40% interest in Cranston Inc. for $250,000. On that date, Cranston's balance sheet disclosed net assets of $430,000. During 2021, Cranston reported net income of $100,000 and paid cash dividends of $30,000. Spark sold inventory costing $40,000 to Cranston during 2021 for $50,000. Cranston used all of this merchandise in its operations during 2021. Any excess cost over fair value is attributable to an unamortized trademark with a 20-year remaining life.Required:Prepare all of Spark's journal entries for 2021 to apply the equity method to this investment.

Unamortized Trademark

The portion of the trademark's cost that has not yet been expensed through amortization in the financial statements, representing the remaining value of the trademark.

Cash Dividends

Cash dividends refer to payments made by a corporation to its shareholders, usually out of its profits.

- Understand the principles and execute the equity method in investment accounting practices.

- Craft journal entries for investments under the equity method, addressing initial recording, the recording of net income or loss from the investee, and recognition of received dividends.

- Measure and defer acknowledgment of gross profit derived from inter-entity inventory sales, ensuring its proper attribution in following periods.

Verified Answer

KB

Kendra Barnett6 days ago

Final Answer :

**Note: All merchandise was used, so no deferral entry is needed.

**Note: All merchandise was used, so no deferral entry is needed.

**Note: All merchandise was used, so no deferral entry is needed.

**Note: All merchandise was used, so no deferral entry is needed.

Learning Objectives

- Understand the principles and execute the equity method in investment accounting practices.

- Craft journal entries for investments under the equity method, addressing initial recording, the recording of net income or loss from the investee, and recognition of received dividends.

- Measure and defer acknowledgment of gross profit derived from inter-entity inventory sales, ensuring its proper attribution in following periods.