Asked by Brycen Cluster on Jun 11, 2024

Verified

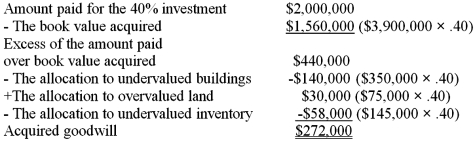

On January 2,2015,the Rambler Company purchased 40% of the outstanding common stock of the AMC Corporation for $2,000,000.AMC's net assets had a book value of $3,900,000 as of January 2,2015.AMC's buildings were undervalued by $350,000,their land was overvalued by $75,000,and their inventory was undervalued by $145,000.

Required:

Determine the amount of goodwill that Rambler acquired as a result of the AMC stock purchase.

Goodwill

An intangible asset representing the value of a company's brand, customer relationships, and other non-physical assets acquired during a purchase.

Common Stock

Represents ownership shares in a corporation, giving holders voting rights and a share in the company's profits through dividends.

Undervalued

Describes a security or other type of investment that is selling for a price presumed to be less than its true intrinsic value.

- Ascertain and calculate goodwill during business consolidations.

Verified Answer

LS

Learning Objectives

- Ascertain and calculate goodwill during business consolidations.