Asked by Cassandra Myers on May 18, 2024

Verified

On September 30 after all monthly postings had been completed the Accounts Receivable control account in the general ledger had a debit balance of $245000; the Accounts Payable control account had a credit balance of $109000.

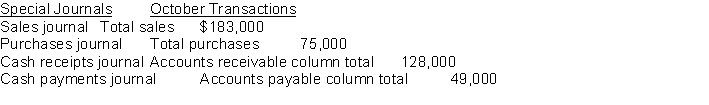

The October transactions recorded in the special journals are presented below.  Instructions

Instructions

Compute the balances of the (1) Accounts Receivable and (2) Accounts Payable control accounts after the monthly postings on October 31.

Control Accounts

Summary accounts in the general ledger that consolidate the details recorded in subsidiary ledgers.

General Ledger

A complete record of all financial transactions over the life of a company.

- Assess and reconcile anomalies between control accounts and subsidiary ledgers.

- Appreciate the impact of specific transactions on financial statements and ledger balances.

Verified Answer

HN

Harish NaiduMay 23, 2024

Final Answer :

(1) Accounts Receivable balance = $300000 ($245000 + $183000 - $128000)

(2) Accounts Payable balance = $135000 ($109000 + $75000 - $49000)

(2) Accounts Payable balance = $135000 ($109000 + $75000 - $49000)

Learning Objectives

- Assess and reconcile anomalies between control accounts and subsidiary ledgers.

- Appreciate the impact of specific transactions on financial statements and ledger balances.

Related questions

Spencer Company Uses Four Special Journals (Cash Receipts Cash Payments ...

The Entries in the Accounts Receivable Credit Column of the ...

At the End of the Month the Accountant for Sequoia ...

The Balance of a Control Account in the General Ledger ...

The Total of the Individual Account Balances in the Accounts ...