Asked by Megan Byers on May 21, 2024

Verified

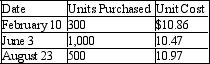

One of the methods permitted by Generally Accepted Accounting Principles for reporting the value of a firm's inventory is weighted-average inventory pricing. The Boswell Corporation began its fiscal year with an inventory of 156 units valued at $10.55 per unit. During the year it made the purchases listed in the following table.

At the end of the year, 239 units remained in inventory. Determine: a) The weighted-average cost of the units purchased during the year. b) The weighted-average cost of the beginning inventory and all units purchased during the year. c) The value of the ending inventory based on the weighted-average cost calculated in b.

Weighted-Average Inventory

A method of calculating the cost of inventory that takes into account the cost of goods sold and the remaining inventory.

Generally Accepted Accounting Principles

A set of rules and standards designed to improve the clarity, consistency, and comparability of financial reporting across different entities.

Fiscal Year

An accounting period of twelve months used for government or corporate financial reporting and budgeting, not necessarily aligning with the calendar year.

- Ascertain average costs and assess weighted averages in monetary transactions.

Verified Answer

Learning Objectives

- Ascertain average costs and assess weighted averages in monetary transactions.

Related questions

An Investor Accumulated 1800 Shares of Microtel Corporation Over a ...

In What Circumstance Should You Calculate a Weighted Average Instead ...

One Year Ago, Ming Allocated the Funds in Her Portfolio ...

Anthony Began the Year with $96,400 Already Invested in His ...

In April, One of the Processing Departments at Terada Corporation ...