Asked by Betty ty_re on Apr 25, 2024

Verified

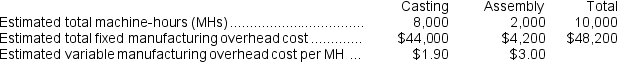

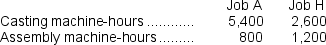

Parido Corporation has two manufacturing departments--Casting and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job H.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job H.There were no beginning inventories.Data concerning those two jobs follow:  Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.The amount of manufacturing overhead applied to Job H is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.The amount of manufacturing overhead applied to Job H is closest to:

A) $8,328

B) $26,372

C) $18,316

D) $18,044

Predetermined Overhead Rate

A predetermined overhead rate is the rate used to allocate estimated overhead costs to products or services based on a specific cost driver.

Machine-Hours

The total hours that machinery is operated in the production process, used as a basis for allocating manufacturing overhead.

- Determine the allocation methodology of manufacturing overhead to distinct job operations and understand its impact on job cost analysis.

- Calculate and interpret the selling price of jobs based on cost-plus pricing strategies using manufacturing overhead rates.

Verified Answer

AM

Angel Matos Jr6 days ago

Final Answer :

B

Explanation :

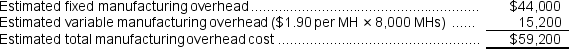

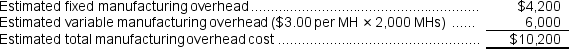

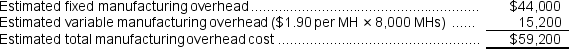

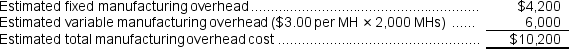

The first step is to calculate the estimated total overhead costs in the two departments.

Casting Assembly

Assembly  The second step is to combine the estimated manufacturing overhead costs in the two departments ($59,200 + $10,200 = $69,400)to calculate the plantwide predetermined overhead rate as follow:

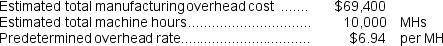

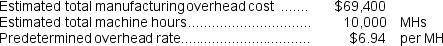

The second step is to combine the estimated manufacturing overhead costs in the two departments ($59,200 + $10,200 = $69,400)to calculate the plantwide predetermined overhead rate as follow:  The overhead applied to Job H is calculated as follows:

The overhead applied to Job H is calculated as follows:

Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $6.94 per MH x (2,600 MHs + 1,200 MHs)

= $6.94 per MH x (3,800 MHs)

= $26,372

Casting

Assembly

Assembly  The second step is to combine the estimated manufacturing overhead costs in the two departments ($59,200 + $10,200 = $69,400)to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments ($59,200 + $10,200 = $69,400)to calculate the plantwide predetermined overhead rate as follow:  The overhead applied to Job H is calculated as follows:

The overhead applied to Job H is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $6.94 per MH x (2,600 MHs + 1,200 MHs)

= $6.94 per MH x (3,800 MHs)

= $26,372

Learning Objectives

- Determine the allocation methodology of manufacturing overhead to distinct job operations and understand its impact on job cost analysis.

- Calculate and interpret the selling price of jobs based on cost-plus pricing strategies using manufacturing overhead rates.

Related questions

Stockmaster Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Doakes Corporation Uses a Job-Order Costing System with a Single ...

Juanita Corporation Uses a Job-Order Costing System and Applies Overhead ...

Coates Corporation Uses a Job-Order Costing System with a Single ...

Leisure Life Manufactures a Variety of Sporting Equipment ...