Asked by Zarria Turner on Jul 13, 2024

Verified

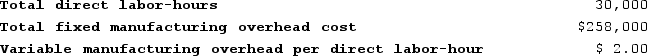

Pasko Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

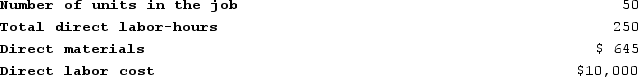

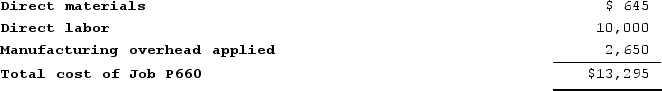

Recently Job P660 was completed with the following characteristics:

Recently Job P660 was completed with the following characteristics:

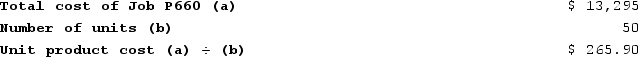

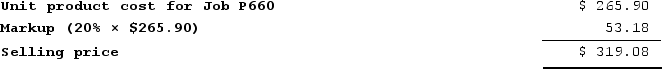

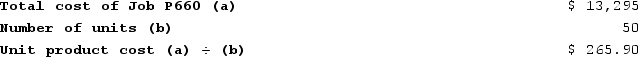

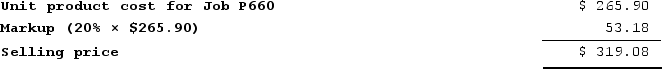

Required:Calculate the selling price for Job P660 if the company marks up its unit product costs by 20%.

Required:Calculate the selling price for Job P660 if the company marks up its unit product costs by 20%.

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate manufacturing overhead costs to products based on a specific activity base.

Manufacturing Overhead

Indirect costs related to manufacturing, such as utilities, maintenance, and salaries for managers, not directly involved in production.

- Compute the sale price of particular tasks utilizing a markup percentage as the basis.

Verified Answer

LM

Louisa MouthonJul 15, 2024

Final Answer :

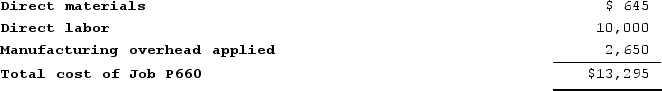

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base) = $258,000 + ($2.00 per direct labor-hour × 30,000 direct labor-hours) = $258,000 + $60,000 = $318,000Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $318,000 ÷ 30,000 direct labor-hours = $10.60 per direct labor-hourOverhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job = $10.60 per direct labor-hour × 250 direct labor-hours = $2,650

Learning Objectives

- Compute the sale price of particular tasks utilizing a markup percentage as the basis.

Related questions

Mcewan Corporation Uses a Job-Order Costing System with a Single ...

Amason Corporation Has Two Production Departments, Forming and Assembly ...

Neale Burgraaf Wants to Purchase a Halogen Lamp for Her ...

As a Source of Income After Retirement, Ian Donnelly Sells ...

The Markup Percent Is Based on Selling Price ...