Asked by Aaliyah Simoné on Jun 27, 2024

Verified

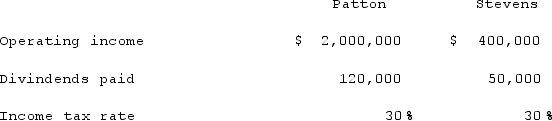

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of gross profit on intra-entity transfers of inventory and the inventory is still held by Stevens at the end of the year. Patton uses the initial value method to account for the investment in Stevens.How much will the consolidated group save if it decides to file a consolidated income tax return?

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of gross profit on intra-entity transfers of inventory and the inventory is still held by Stevens at the end of the year. Patton uses the initial value method to account for the investment in Stevens.How much will the consolidated group save if it decides to file a consolidated income tax return?

Consolidated Income Tax Return

A single income tax return filed by an affiliated group of corporations, combining their tax liabilities.

Operating Income

Represents the profit a company makes after deducting operating expenses such as wages and cost of goods sold (COGS), but before interest and taxes.

Initial Value Method

An accounting approach where investments are first recorded at their acquisition cost.

- Understand the qualifications and perks of lodging a consolidated income tax return versus individual filings.

Verified Answer

ZK

Zybrea KnightJul 04, 2024

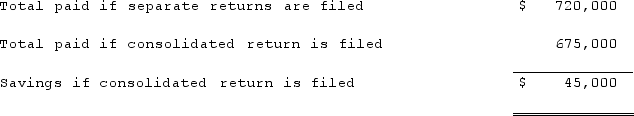

Final Answer :  (Also computed as $150,000 intra-entity gross profit × 30% tax rate)

(Also computed as $150,000 intra-entity gross profit × 30% tax rate)

(Also computed as $150,000 intra-entity gross profit × 30% tax rate)

(Also computed as $150,000 intra-entity gross profit × 30% tax rate)

Learning Objectives

- Understand the qualifications and perks of lodging a consolidated income tax return versus individual filings.