Asked by Nancy Lainez on Jul 22, 2024

Verified

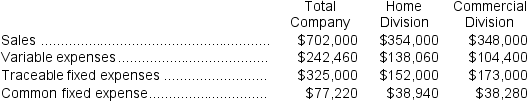

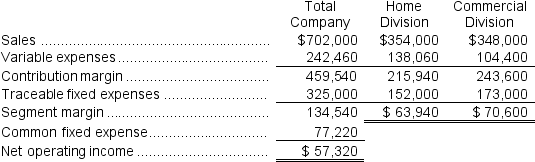

Petteway Corporation has two divisions: Home Division and Commercial Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

Break-even

The point at which total revenues equal total costs, resulting in no profit or loss.

Sales Dollars

The total revenue a company generates from sales activities before any expenses are deducted.

Common Fixed Expenses

Expenses that do not change with the level of production or sales and are shared by different segments or products of a company.

- Assess the break-even points for various divisions and the overall firm.

- Understand the allocation of common fixed expenses among divisions.

Verified Answer

a.Home Division break-even:

a.Home Division break-even:Segment CM ratio = Segment contribution margin ÷ Segment sales

= $215,940 ÷ $354,000 = 0.610

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $152,000 ÷ 0.610 = $249,180

b.Commercial Division break-even:

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $243,600 ÷ $348,000 = 0.700

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $173,000 ÷ 0.700 = $247,143

c.The company's overall break-even sales:

CM ratio = Contribution margin ÷ Sales

= $459,540 ÷ $702,000 = 0.655 (rounded)

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $325,000 + $77,220 = $402,220

Dollar sales to break even = Total fixed expenses ÷ CM ratio

= $402,220 ÷ 0.655 = $614,437 (using the unrounded CM ratio)

Learning Objectives

- Assess the break-even points for various divisions and the overall firm.

- Understand the allocation of common fixed expenses among divisions.

Related questions

Kneeland Corporation Has Two Divisions: Grocery Division and Convenience Division ...

Fausnaught Corporation Has Two Major Business Segments--Retail and Wholesale ...

Clouthier Corporation Has Two Divisions: Home Division and Commercial Division ...

Holts Corporation Has Two Divisions: Xi and Sigma ...

Delisa Corporation Has Two Divisions: Division L and Division Q ...