Asked by Anneiry de la cruz on Jun 14, 2024

Verified

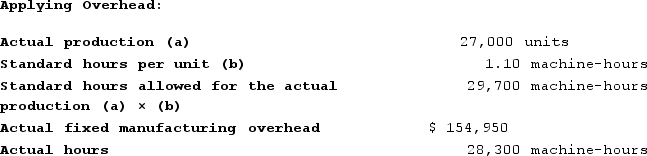

Plantier Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. The budgeted fixed manufacturing overhead for the year was $136,950 and the budgeted hours were 27,500 machine-hours. Data concerning the actual results for the most recent year appear below:

Required:

Required:

a. Determine the fixed overhead budget variance for the year.

b. Determine the fixed overhead volume variance for the year.

Fixed Overhead Budget

A plan for the fixed costs involved in operating a business, which do not vary with levels of production or sales.

Standard Machine-Hours

The predetermined amount of time that machines are expected to operate to produce a set quantity of goods.

- Distinguish between projected and actual performance discrepancies.

- Comprehend the importance of machine-hours in determining costs and analyzing variances.

Verified Answer

PR

peggy robertsJun 14, 2024

Final Answer :

a. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $154,950 − $136,950 = $18,000 Unfavorable

b. Fixed component of the predetermined overhead rate = $136,950/27,500 machine-hours

= $4.98 per machine-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $136,950 − ($4.98 per machine-hour × 29,700 machine-hours)

= $136,950 − ($147,906)

= $10,956 Favorable

= $154,950 − $136,950 = $18,000 Unfavorable

b. Fixed component of the predetermined overhead rate = $136,950/27,500 machine-hours

= $4.98 per machine-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $136,950 − ($4.98 per machine-hour × 29,700 machine-hours)

= $136,950 − ($147,906)

= $10,956 Favorable

Learning Objectives

- Distinguish between projected and actual performance discrepancies.

- Comprehend the importance of machine-hours in determining costs and analyzing variances.

Related questions

Flick Company Uses a Standard Cost System in Which Manufacturing ...

Holl Corporation Has Provided the Following Data for November ...

Moozi Dairy Products Processes and Sells Two Products: Milk and ...

Why Are Budgets Useful in the Planning Process ...

A Budget Can Be Used as a Basis for Evaluating ...