Asked by Brendan Aikin on May 23, 2024

Verified

Rick Company uses straight-line depreciation for its property,plant,and equipment which-stated at cost-consisted of the following:

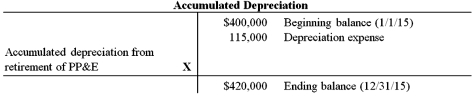

20152014 Land $25,000$25,000 Buildings 195,000195,000 Machinery and equipment 795,000750,0001,015,000970,000 - Accumulated depreciation (420,000)‾(400,000)‾ Net book value 5595,000$570,000\begin{array}{lcc} & \mathbf{2 0 1 5} & \mathbf{2 0 1 4} \\\text { Land } & \$ 25,000 & \$ 25,000 \\\text { Buildings } & 195,000 & 195,000 \\\text { Machinery and equipment } & 795,000 & 750,000 \\& 1,015,000 & 970,000 \\\text { - Accumulated depreciation } & \underline{(420,000)} & \underline{(400,000)} \\ \text { Net book value } &5595,000 & \$ 570,000\end{array} Land Buildings Machinery and equipment - Accumulated depreciation Net book value 2015$25,000195,000795,0001,015,000(420,000)5595,0002014$25,000195,000750,000970,000(400,000)$570,000

Rick's depreciation expense for 2015 and 2014 was $115,000 and $110,000 respectively.

Required:

What amount was debited to accumulated depreciation during 2015 because of property,plant,and equipment retirements?

Straight-Line Depreciation

A method for allocating the financial value of a tangible asset through its lifespan in even yearly payments.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset over its useful life.

Machinery and Equipment

Physical assets used in a business operation to produce goods or services, not including buildings or property.

- Recognize and record the costs associated with property, plant, and equipment retirements.

Verified Answer

$400,000 + $115,000 - X = $420,000

X = $95,000

Feedback:Rick Company must have debited accumulated depreciation $95,000 during 2015 because of property,plant,and equipment retirements.

Learning Objectives

- Recognize and record the costs associated with property, plant, and equipment retirements.

Related questions

On April 1, 2010, Richer Corporation Purchased a New Machine ...

Randal's Rifles Purchased Some Equipment by Issuing a Three-Year 6 ...

The Roth Company Incurred the Following Costs in the Acquisition ...

Which One of the Following Types of Costs Should Not ...

The Debit for a Sales Tax Paid on the Purchase ...