Asked by Shibuya Daemon on May 02, 2024

Verified

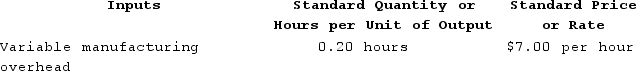

Sade Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

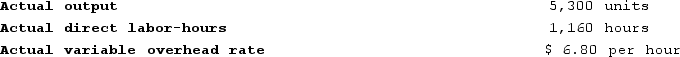

The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

Required:a. Compute the variable overhead rate variance for December.b. Compute the variable overhead efficiency variance for December.

Required:a. Compute the variable overhead rate variance for December.b. Compute the variable overhead efficiency variance for December.

Variable Overhead Rate

The rate at which variable overhead costs are allocated to each unit of production, which may vary with the level of output.

Direct Labor-Hours

Overall employment hours dedicated directly to the manufacturing operation.

- Evaluate the variable overhead rate and analyze efficiency variances.

- Conduct an analysis on beneficial and adverse variances to grasp their implications.

Verified Answer

DE

Devonte EdwardsMay 07, 2024

Final Answer :

a. Variable overhead rate variance = (Actual hours × Actual hours) − (Actual hours × Standard rate)

= Actual hours × (Actual hours − Standard rate)

= 1,160 hours × ($6.80 per hour − $7.00 per hour)

= 1,160 hours × (−$0.20 per hour)

= $232 Favorable

b. Standard hours = 5,300 units × 0.20 hours per unit = 1,060 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,160 hours − 1,060 hours) × $7.00 per hour

= (100 hours) × $7.00 per hour

= $700 Unfavorable

= Actual hours × (Actual hours − Standard rate)

= 1,160 hours × ($6.80 per hour − $7.00 per hour)

= 1,160 hours × (−$0.20 per hour)

= $232 Favorable

b. Standard hours = 5,300 units × 0.20 hours per unit = 1,060 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,160 hours − 1,060 hours) × $7.00 per hour

= (100 hours) × $7.00 per hour

= $700 Unfavorable

Learning Objectives

- Evaluate the variable overhead rate and analyze efficiency variances.

- Conduct an analysis on beneficial and adverse variances to grasp their implications.

Related questions

Bondi Corporation Makes Automotive Engines ...

Boldrin Incorporated Has a Standard Cost System ...

Glaab Incorporated Has Provided the Following Data Concerning One of ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...