Asked by Shauntae Davis on Jun 06, 2024

Verified

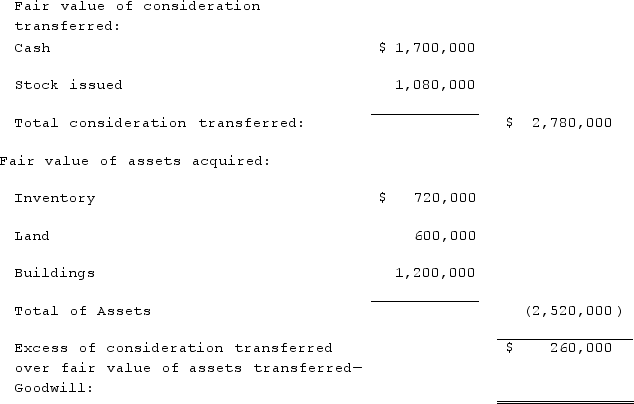

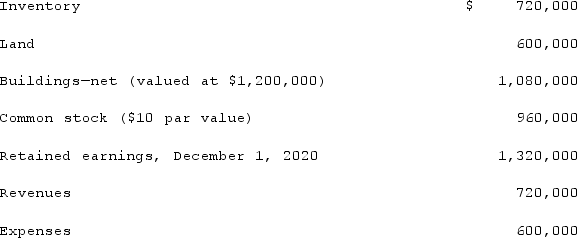

Salem Co. had the following account balances as of December 1, 2020:  Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock. Determine the balance for Goodwill that would be included in a December 1, 2020, consolidation as a result of the acquisition.

Common Stock

Equity shares representing ownership in a company, giving holders voting rights and a share in the company’s profits through dividends.

Goodwill

An intangible asset that arises when a company acquires another for a price higher than the fair value of its net assets, representing items such as brand reputation or customer loyalty.

Par Value

The nominal value designated by the issuer for a bond or stock, which doesn't reflect its actual market price.

- Determine the valuation of goodwill and various intangible assets derived from business consolidations.

Verified Answer

MA

Learning Objectives

- Determine the valuation of goodwill and various intangible assets derived from business consolidations.