Asked by Julissa Vicharelli on Apr 28, 2024

Verified

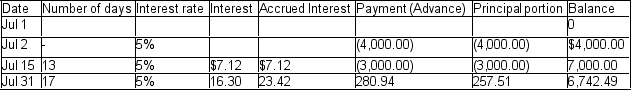

Sam has a $10,000 personal line of credit. The interest rate is prime + 2%. On the last day of each month, a payment equal to the greater of $200 or 4% of the current balance (including the current month's accrued interest) is deducted from his chequing account. On July 2, he withdrew $4,000 and another $3,000 on July 15. The prime rate during July was 3%. Prepare a loan repayment schedule for the month of July.

Personal Line

A personal line of credit, a type of unsecured loan that provides a borrower access to a set amount of money which they can borrow from as needed.

Prime Rate

The interest rate that banks charge their most creditworthy customers.

Loan Repayment

The process through which a borrower returns borrowed money to the lender, usually in scheduled installments.

- Analyze and construct loan repayment schedules incorporating principal and interest components.

Verified Answer

ZK

Learning Objectives

- Analyze and construct loan repayment schedules incorporating principal and interest components.