Asked by Dayna McCormick on May 12, 2024

Verified

Samantha Co.has a defined benefit pension plan that has experienced differences between its expected and actual projected benefit obligation.Data on the plan as of January 1, 2010, follow:

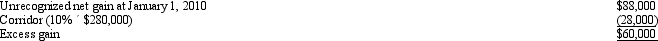

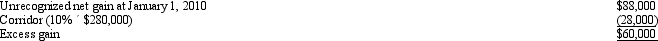

Unrecogrized net gain $88,000 Fair value of plan assets 250,000 Actual projected benefit obligation 280,000\begin{array}{ll}\text { Unrecogrized net gain } & \$ 88,000 \\\text { Fair value of plan assets } & 250,000 \\\text { Actual projected benefit obligation } & 280,000\end{array} Unrecogrized net gain Fair value of plan assets Actual projected benefit obligation $88,000250,000280,000

There was no difference between the company's expected and actual return on plan assets during 2010.The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2010 and indicate whether it is an increase or decrease in the pension expense calculation.

Unrecognized Net Gain

A profit that has been realized but not yet recorded in the financial statements of a company.

Projected Benefit Obligation

The present value of estimated future pension benefits owed to employees, based on expected salary increases.

- Investigate how actuarial gains and losses influence pension schemes.

Verified Answer

AC

Alonzo Calderon-BosticMay 19, 2024

Final Answer :  Net gain deducted in pension expense calculation = $60, 000/12 years = $5, 000

Net gain deducted in pension expense calculation = $60, 000/12 years = $5, 000

Net gain deducted in pension expense calculation = $60, 000/12 years = $5, 000

Net gain deducted in pension expense calculation = $60, 000/12 years = $5, 000

Learning Objectives

- Investigate how actuarial gains and losses influence pension schemes.