Asked by MaryJean Throm on Jun 03, 2024

Verified

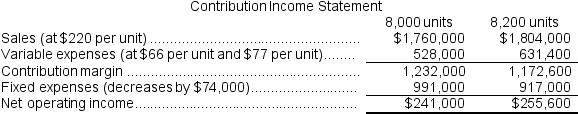

Sannella Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $991,000 per month.The company is currently selling 8,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange, the sales staff would accept a decrease in their salaries of $74,000 per month.(This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $991,000 per month.The company is currently selling 8,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange, the sales staff would accept a decrease in their salaries of $74,000 per month.(This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $1,246,600

B) increase of $14,600

C) decrease of $133,400

D) increase of $71,800

Sales Commissions

Payments made to sales staff based on the value or volume of sales generated.

Fixed Expenses

Expenses that remain constant regardless of the amount of output or sales, including rent, salaries, and insurance costs.

Monthly Net Operating Income

The profit a company generates from its normal business operations, excluding unusual or infrequent items, on a monthly basis.

- Compute and elucidate the impact of marketing and commission expenses on the net income from operations.

Verified Answer

Net operating income would increase by $14,600.

Net operating income would increase by $14,600.

Learning Objectives

- Compute and elucidate the impact of marketing and commission expenses on the net income from operations.

Related questions

Data Concerning Kardas Corporation's Single Product Appear Below: the ...

This Question Is to Be Considered Independently of All Other ...

This Question Is to Be Considered Independently of All Other ...

Shelhorse Corporation Produces and Sells a Single Product ...

Hamiel Corporation Produces and Sells a Single Product ...