Asked by haneefa etimady on May 16, 2024

Verified

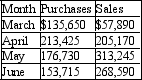

Sawchuk's Home and Garden Centre files monthly HST returns. The purchases on which it paid the HST and the sales on which it collected the HST for the last four months were as follows:

Based on an HST rate of 13%, calculate the HST remittance or refund due for each month.

HST Remittance

The process of sending payments of the Harmonized Sales Tax collected by businesses to the relevant tax authority.

HST Returns

The process of reporting and remitting the Harmonized Sales Tax collected by businesses to the government, typically on a periodic basis.

- Comprehension and utilization of business tax computation methods.

- Acquire knowledge on the basics of GST and HST, focusing on remittance and refund processes.

Verified Answer

BK

Bryce KirbyMay 17, 2024

Final Answer :

March) $(10,108.80)

April) $(1,073.15)

May) $17,746.95

June) $14,933.75

April) $(1,073.15)

May) $17,746.95

June) $14,933.75

Learning Objectives

- Comprehension and utilization of business tax computation methods.

- Acquire knowledge on the basics of GST and HST, focusing on remittance and refund processes.