Asked by Thomas Waller on May 06, 2024

Verified

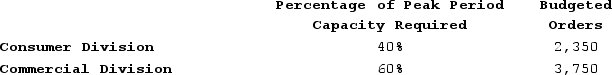

Schabel Corporation has two operating divisions-a Consumer Division and a Commercial Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $78 per order. The Customer Service Department's fixed costs are budgeted at $270,000 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year, actual Customer Service Department variable costs totaled $483,570 and fixed costs totaled $298,128. The Consumer Division had a total of 2,372 orders and the Commercial Division had a total of 3,703 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Customer Service Department variable costs totaled $483,570 and fixed costs totaled $298,128. The Consumer Division had a total of 2,372 orders and the Commercial Division had a total of 3,703 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

A) $28,128

B) $37,848

C) $9,720

D) $0

Customer Service Department

A division within a company that handles customer inquiries, complaints, and provides support and assistance.

Variable Costs

Money spent that varies depending on the quantity of items made or sold, including the expenses for materials and manpower.

Fixed Costs

Costs that remain constant regardless of the amount of goods produced or sold during a specific timeframe, including rent, wages, and insurance premiums.

- Analyze the outlays that should not be attributed to divisional operations, and recognize the basis for such decisions.

Verified Answer

Fixed costs = $270,000

Variable costs per order = $78

Total orders = 2,372 + 3,703 = 6,075

Total variable costs = $78 x 6,075 = $474,150

Total budgeted cost = Fixed costs + Variable costs = $270,000 + $474,150 = $744,150

The actual total cost incurred by the Customer Service Department is $483,570 + $298,128 = $781,698.

Therefore, the actual cost that should NOT be charged to the operating divisions is:

Actual cost - Total variable cost = $781,698 - $474,150 = $307,548.

However, we only need to find the amount that should not be charged to the operating divisions, which means we need to allocate the actual fixed cost incurred by the Customer Service Department based on the number of orders from each division. The allocation is as follows:

Consumer Division:

Fixed cost allocation = ($270,000 ÷ 6,075 orders) x 2,372 orders = $108,895.06

Commercial Division:

Fixed cost allocation = ($270,000 ÷ 6,075 orders) x 3,703 orders = $161,232.34

Total fixed cost allocation = $108,895.06 + $161,232.34 = $270,127.40

Actual cost that should NOT be charged = Actual total cost - Total variable cost - Fixed cost allocation

= $781,698 - $474,150 - $270,127.40

= $37,848.60

Therefore, the best answer is B.

Learning Objectives

- Analyze the outlays that should not be attributed to divisional operations, and recognize the basis for such decisions.

Related questions

The Downstate Block Company Has a Trucking Department That Delivers ...

Corbel Corporation Has Two Divisions: Division a and Division B ...

Corbel Corporation Has Two Divisions: Division a and Division B ...

After All Discounts, the Net Cost of a Product Was ...

After All Discounts, the Net Cost of a Product Was ...