Asked by Haimanti Bhattacharyya on Jul 04, 2024

Verified

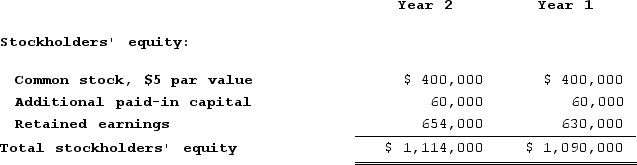

Sperle Corporation has provided the following data concerning its stockholders' equity accounts:  Net income for Year 2 was $30,400. Dividends on common stock during Year 2 totaled $6,400. The market price of common stock at the end of Year 2 was $3.08 per share.The company's dividend yield ratio for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

Net income for Year 2 was $30,400. Dividends on common stock during Year 2 totaled $6,400. The market price of common stock at the end of Year 2 was $3.08 per share.The company's dividend yield ratio for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) 21.1%

B) 2.6%

C) 1.6%

D) 14.7%

Dividend Yield Ratio

A financial ratio that shows how much a company pays out in dividends each year relative to its share price, often used by investors to gauge the income a stock provides.

Dividends

Payments made by a corporation to its shareholder members, usually as a distribution of profits.

Common Stock

A type of equity security that represents ownership in a corporation, providing voting rights and a share in the company's profits via dividends.

- Acquire knowledge on the relevance and methodology for determining ratios related to dividends, like the dividend payout ratio and dividend yield ratio.

Verified Answer

Dividend per share = Dividends on common stock / Total number of common shares

Dividend per share = $6,400 / 2,000 = $3.20

Market price per share = $3.08

Dividend yield ratio = $3.20 / $3.08 = 1.04 = 2.6% (rounded to 2 decimal places)

Learning Objectives

- Acquire knowledge on the relevance and methodology for determining ratios related to dividends, like the dividend payout ratio and dividend yield ratio.

Related questions

Recher Corporation's Common Stock Has a Par Value of $3 ...

Groeneweg Corporation Has Provided the Following Data: Dividends on ...

Uhri Corporation Has Provided the Following Data: Dividends on ...

Kovack Corporation's Net Operating Income in Year 2 Was $66,571 ...

The Following Data Were Reported for Favre Company ...