Asked by Chelsey Wheatley on May 09, 2024

Verified

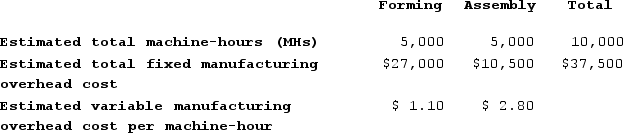

Stockmaster Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

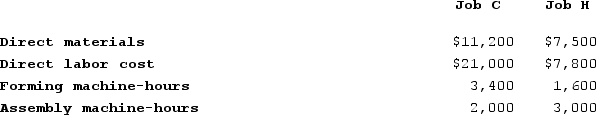

During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $96,989

B) $88,172

C) $25,192

D) $62,980

Calculated Selling Price

The calculated selling price is the price at which a product must be sold to cover its costs and achieve a desired profit margin.

Markup

The amount added to the cost price of goods to cover overhead and profit.

Predetermined Overhead Rate

A rate used to allocate overhead costs to products or services, calculated in advance based on estimated costs and activity levels.

- Assess the overall price tag of a project, integrating expenses from direct materials, direct labor, and the imposition of overhead.

- Compute the retail price of work by factoring in the costs of production and agreed-upon markup rates.

Verified Answer

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Cost / Estimated Total Machine Hours

Predetermined Overhead Rate = $860,000 / 17,200 hours

Predetermined Overhead Rate = $50 per machine hour

Next, we need to calculate the total manufacturing cost for each job using the given data.

Total Manufacturing Cost = Direct Materials Cost + Direct Labor Cost + Manufacturing Overhead Cost

Job C's Total Manufacturing Cost = $55,000 + $60,000 + ($50 x 1,200) = $175,000

Job H's Total Manufacturing Cost = $38,000 + $45,000 + ($50 x 1,800) = $173,000

Then, we need to calculate the selling price for each job using the given markup of 40% on manufacturing cost.

Selling Price = Total Manufacturing Cost x (1 + Markup)

Job C's Selling Price = $175,000 x (1 + 0.4) = $245,000

Job H's Selling Price = $173,000 x (1 + 0.4) = $242,200

Therefore, the calculated selling price for Job C is closest to $88,172 (option B).

Learning Objectives

- Assess the overall price tag of a project, integrating expenses from direct materials, direct labor, and the imposition of overhead.

- Compute the retail price of work by factoring in the costs of production and agreed-upon markup rates.

Related questions

Sargent Corporation Applies Overhead Cost to Jobs on the Basis ...

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Grib Corporation Uses a Predetermined Overhead Rate Based on Direct ...

Placker Corporation Uses a Job-Order Costing System with a Single ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...