Asked by Taylor Fujimoto on May 16, 2024

Verified

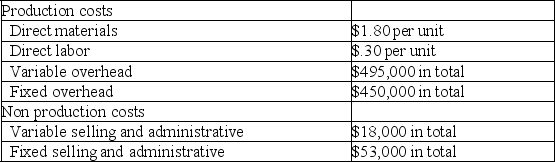

Stonehenge Inc.,a manufacturer of landscaping blocks,began operations on April 1 of the current year.During this time,the company produced 750,000 units and sold 720,000 units at a sales price of $9 per unit.Cost information for this period is shown in the following table:

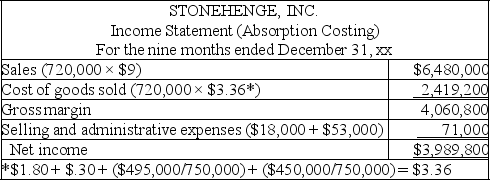

a.Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

a.Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

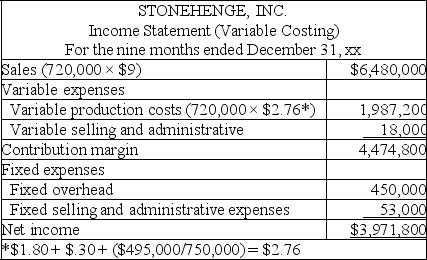

b.Prepare Stonehenge's December 31st income statement for the current year under variable costing.

Absorption Costing

An accounting method that includes all of the manufacturing costs in the cost of a product, including direct labor, materials, and overhead.

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in unit product costs.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, resulting in a profit or loss.

- Investigate the influence of assigning costs on the financial outcomes depicted in income statements with different costing methodologies.

Verified Answer

GB

Learning Objectives

- Investigate the influence of assigning costs on the financial outcomes depicted in income statements with different costing methodologies.

b.

b.