Asked by Sheryl Kambuni on May 22, 2024

Verified

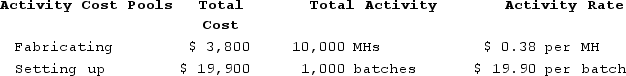

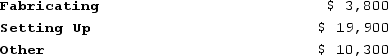

Sukhu Corporation's activity-based costing system has three activity cost pools--Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

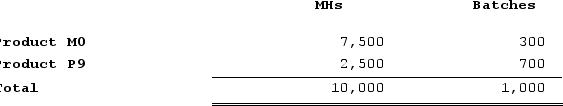

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Required:Calculate activity rates for each activity cost pool using activity-based costing

Required:Calculate activity rates for each activity cost pool using activity-based costing

Activity-Based Costing

A costing methodology that assigns the costs of overhead activities to products or services based on their consumption of those activities, aiming to provide more accurate cost information.

Activity Cost Pools

Pools of overhead costs assigned to products and services according to the activities that drive costs.

Machine-Hours

A measure of production output or activity based on the number of hours machines are in operation.

- Get to know the principles of Activity-Based Costing (ABC).

- Measure the rates of activities across distinct cost pools within an Activity-Based Costing scheme.

Verified Answer

Learning Objectives

- Get to know the principles of Activity-Based Costing (ABC).

- Measure the rates of activities across distinct cost pools within an Activity-Based Costing scheme.

Related questions

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Ciulla Corporation Manufactures Two Products: Product J12N and Product H63J ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...