Asked by eliza mason on Jul 19, 2024

Verified

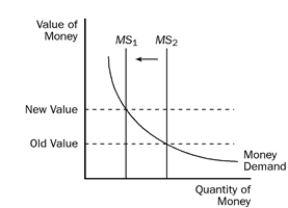

Suppose the Fed sells government bonds. Use a graph of the money market to show what this does to the value of money.

Fed

Short for the Federal Reserve System, it's the central banking system of the United States, responsible for monetary policy.

Government Bonds

Government bonds are debt securities issued by a government to support government spending and obligations, often considered low-risk investments.

Value of Money

The purchasing power of money, which can vary based on inflation or deflation, affecting how much goods and services can be bought.

- Comprehend the reasons behind and the consequences of hyperinflation.

Verified Answer

When the Fed sells government bonds, the money supply decreases. This shifts the money supply curve from MS2 to MS1 and makes the value of money increase. Since money is worth more, it takes less to buy goods with it, which means the price level falls.

Learning Objectives

- Comprehend the reasons behind and the consequences of hyperinflation.

Related questions

Explain the Adjustment Process in the Money Market That Creates ...

Hyperinflations Are Associated with Governments Printing Money to Finance Expenditures

Hyperinflation Is Generally Defined as Inflation That Exceeds 50 Percent ...

The Hyperinflation in Zimbabwe Ended in April 2009 When the ...

Economists Agree That Increases in the Money-Supply Growth Rate Increase ...