Asked by Ikhlas Salih on Jun 21, 2024

Verified

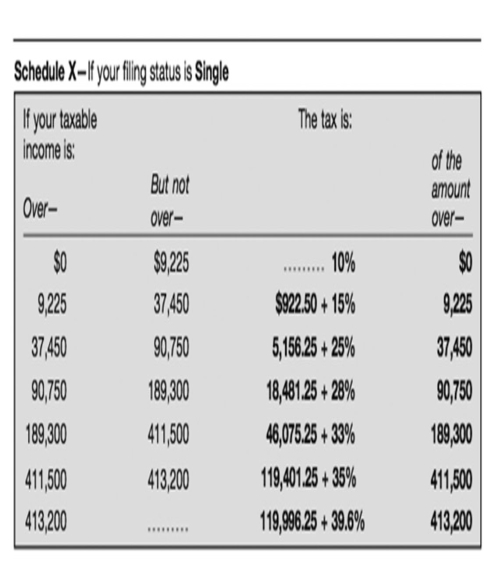

Tanika is filing single and has a taxable income of $110,000.It took many hours throughout the year to keep records of deductions and to file her taxes at the end of the year.Use the table below to calculate her taxes.If an effective tax rate is the percentage of gross income paid in federal taxes,what is Tanika's effective tax rate?

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing total tax paid by the taxable income.

Taxable Income

The amount of an individual's or organization's income used to determine how much tax is owed, minus deductions and exemptions.

Federal Taxes

Taxes imposed by the federal government on income, property, and consumption to fund national programs and services.

- Compute effective tax rates and understand their significance in tax planning.

Verified Answer

JH

Learning Objectives

- Compute effective tax rates and understand their significance in tax planning.