Asked by Abo Yousef Khaleel on Apr 25, 2024

Verified

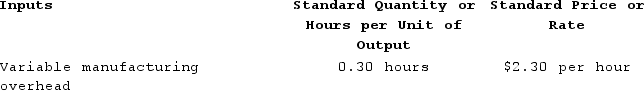

Termeer Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for August:

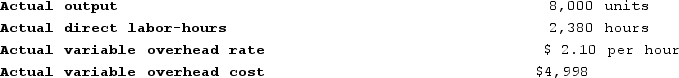

The company has reported the following actual results for the product for August:

The variable overhead efficiency variance for the month is closest to:

The variable overhead efficiency variance for the month is closest to:

A) $46 Unfavorable

B) $42 Favorable

C) $46 Favorable

D) $42 Unfavorable

Variable Overhead Efficiency Variance

The difference between the actual variable overhead based on the standard cost and the variable overhead applied to production based on actual activity levels.

Direct Labor-hours

The total hours of labor directly involved in the production of goods or services.

- Review the efficiency variances of variable overhead in the context of cost governance.

Verified Answer

RY

Rahaf Yassin5 days ago

Final Answer :

C

Explanation :

Variable overhead efficiency variance = (Actual hours - Standard hours) x Variable overhead rate

Actual hours = 2,600

Standard hours = 2,500

Variable overhead rate = $0.40 per direct labor hour

Variable overhead efficiency variance = (2,600 - 2,500) x $0.40 = $40 Favorable

Therefore, the closest answer choice is C, $46 Favorable.

Actual hours = 2,600

Standard hours = 2,500

Variable overhead rate = $0.40 per direct labor hour

Variable overhead efficiency variance = (2,600 - 2,500) x $0.40 = $40 Favorable

Therefore, the closest answer choice is C, $46 Favorable.

Learning Objectives

- Review the efficiency variances of variable overhead in the context of cost governance.

Related questions

Juhasz Corporation Makes a Product with the Following Standards for ...

What Was Tantanka's Variable Overhead Efficiency Variance ...

The Variable Overhead Efficiency Variance Is

If Demand Is Insufficient to Keep Everyone Busy and Workers ...

The Variable Overhead Efficiency Variance Measures the Difference Between the ...