Asked by Marinda Carraway on Jul 19, 2024

Verified

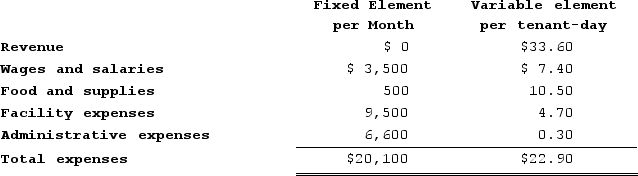

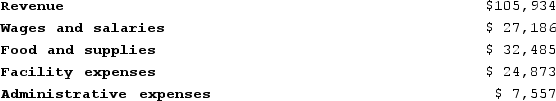

Tessmer Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During January, the kennel budgeted for 3,100 tenant-days, but its actual level of activity was 3,090 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for January:Data used in budgeting:  Actual results for January:

Actual results for January:

The net operating income in the flexible budget for January would be closest to:

The net operating income in the flexible budget for January would be closest to:

A) $13,878

B) $13,788

C) $12,963

D) $13,070

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity, allowing for more accurate budgeting in variable cost scenarios.

Tenant-Days

A metric in the real estate and hospitality industry indicating the total number of days that tenants or guests occupy a space.

- Calculate and interpret variances between planned and actual results.

- Evaluate financial documents to ascertain business performance.

Verified Answer

CR

Christina RiveroJul 25, 2024

Final Answer :

C

Explanation :

The formula used in the budgeting process is:

$36,500 + ($10 × Tenant-Days)

Using the actual level of activity of 3,090 tenant-days, the flexible budget should be:

$36,500 + ($10 × 3,090) = $67,400

The actual operating income for January was $54,437. To determine the net operating income in the flexible budget, we need to subtract the actual variable expenses from the budgeted contribution margin:

Flexible budget contribution margin = ($67,400 - $36,500) = $30,900

Flexible budget variable expenses = ($10 × 3,090) = $30,900

Net operating income in the flexible budget = Flexible budget contribution margin - Flexible budget variable expenses - Fixed expenses

Net operating income in the flexible budget = $30,900 - $30,900 - $8,037 = $(-$8,037)

The negative result shows that the kennel would have incurred a loss in January if it had budgeted for 3,090 tenant-days. Therefore, the kennel did not achieve its budgeted net operating income of $12,963.

$36,500 + ($10 × Tenant-Days)

Using the actual level of activity of 3,090 tenant-days, the flexible budget should be:

$36,500 + ($10 × 3,090) = $67,400

The actual operating income for January was $54,437. To determine the net operating income in the flexible budget, we need to subtract the actual variable expenses from the budgeted contribution margin:

Flexible budget contribution margin = ($67,400 - $36,500) = $30,900

Flexible budget variable expenses = ($10 × 3,090) = $30,900

Net operating income in the flexible budget = Flexible budget contribution margin - Flexible budget variable expenses - Fixed expenses

Net operating income in the flexible budget = $30,900 - $30,900 - $8,037 = $(-$8,037)

The negative result shows that the kennel would have incurred a loss in January if it had budgeted for 3,090 tenant-days. Therefore, the kennel did not achieve its budgeted net operating income of $12,963.

Learning Objectives

- Calculate and interpret variances between planned and actual results.

- Evaluate financial documents to ascertain business performance.

Related questions

What Is the Total Project Cost Incurred by Trance Electronics

The Quarterly Cash Flows from Operations for Two Technology Companies ...

Nobriga Corporation Uses Customers Served as Its Measure of Activity ...

Bickel Corporation Uses Customers Served as Its Measure of Activity ...

Varriano Corporation Bases Its Budgets on the Activity Measure Customers ...