Asked by Blair Harrell on May 21, 2024

Verified

The Ampex Co. manufactures plastic fixtures for residential bathrooms. Currently, it has an opportunity to invest $1,000,000 in the equipment needed to produce other plastic fixtures for kitchen use. If the company decides to sell kitchen fixtures, it has reason to believe that it can generate the following profit stream during a six-year life cycle for kitchen fixtures.

End of Year Profit

1 $10,000

2 100,000

3 500,000

4 600,000

5 400,000

6 200,000

At the end of six years, the company can sell the capital used to make kitchen fixtures for $50,000. If the interest rate on money available to Ampex is 11% per year, should it invest in kitchen fixtures? Does it matter if the 11% per year is in nominal or real terms? Explain.

Interest Rate

The cost, in the form of a percentage of the principal amount, charged by a lender to a borrower for accessing funds or assets.

Profit Stream

Future flow of profits from an investment over time.

Kitchen Fixtures

Permanent installations in kitchens, such as sinks, faucets, and cabinetry, that are essential for the kitchen's functionality.

- Acquire the ability to determine the present value of future cash flows and compute the Net Present Value (NPV) of investment opportunities.

- Examine the economic viability of projects through NPV and various other tools for making investment decisions.

Verified Answer

PP

PRALABH PRASHARMay 23, 2024

Final Answer :

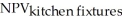

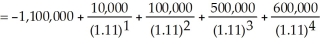

Calculate the NPV for kitchen fixture operation.

+

+  +

+  +

+  = -1,100,000 + 1,222,047

= -1,100,000 + 1,222,047

= 122,047

Thus, since the NPV is greater than zero, the firm should invest in kitchen fixtures.

It does not matter whether the discount rate is in nominal or real terms. What does matter is that cash flows and discount rate be expressed in the same terms. Use either nominal for both or use real for both.

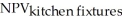

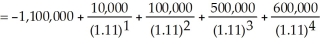

+

+  +

+  +

+  = -1,100,000 + 1,222,047

= -1,100,000 + 1,222,047= 122,047

Thus, since the NPV is greater than zero, the firm should invest in kitchen fixtures.

It does not matter whether the discount rate is in nominal or real terms. What does matter is that cash flows and discount rate be expressed in the same terms. Use either nominal for both or use real for both.

Learning Objectives

- Acquire the ability to determine the present value of future cash flows and compute the Net Present Value (NPV) of investment opportunities.

- Examine the economic viability of projects through NPV and various other tools for making investment decisions.