Asked by Brooke Ramsey on Jun 03, 2024

Verified

The December 31 2015 balance sheet of Barone Company had Accounts Receivable of $400000 and a credit balance in Allowance for Doubtful Accounts of $32000. During 2016 the following transactions occurred: sales on account $1500000; sales returns and allowances $50000; collections from customers $1250000; accounts written off $36000; previously written off accounts of $6000 were collected.

Instructions

(a) Journalize the 2016 transactions.

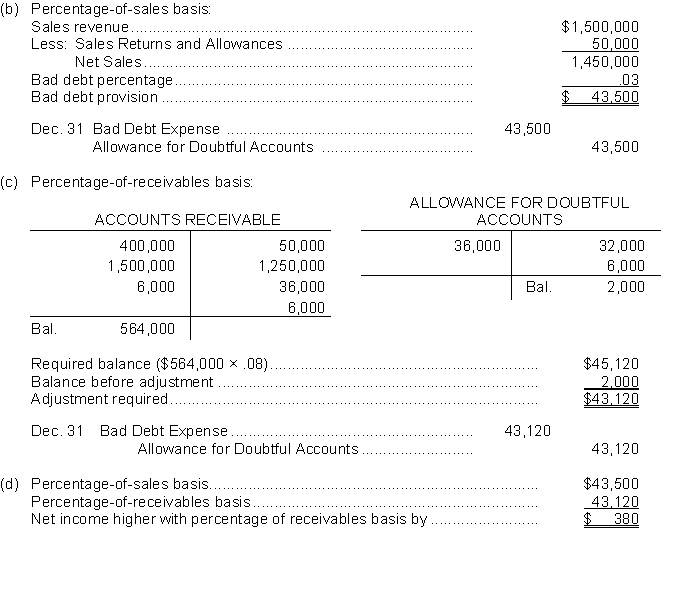

(b) If the company uses the percentage-of-sales basis to estimate bad debt expense and anticipates 3% of net sales to be uncollectible what is the adjusting entry at December 31 2016?

(c) If the company uses the percentage of receivables basis to estimate bad debt expense and determines that uncollectible accounts are expected to be 8% of accounts receivable what is the adjusting entry at December 31 2016?

(d) Which basis would produce a higher net income for 2016 and by how much?

Percentage-of-Sales Basis

A method used in budgeting and planning where certain costs or expenses are based on a fixed percentage of sales.

Accounts Receivable

Money owed to a business by its clients for goods or services that have been delivered but not yet paid for.

Allowance for Doubtful Accounts

A contra-asset account representing the estimated amount of receivables that may not be collected, reducing net accounts receivable to a more realistic value.

- Understand the process of accounting for bad debt expense and recognize the influence of write-offs on the cash realizable value of accounts receivable.

- Compute and comprehend the effect of bad debt expense through percentage estimates derived from net credit sales or balances of accounts receivable.

Verified Answer

Accounts Receivable1,500,000Sales Revenue 1,500,000(To record credit sales) Sales Returns and Allowances 50,000 Accounts Receivable50,000 (To record credits to customers) Cash 1,250,000 Accounts Receivable1,250,000 (To record collection of receivables) Allowance for Doubtful Accounts. 36,000Accounts Receivable 36,000 (To write off specific accounts) Accounts Receivable6,000 Allowance for Doubtful Accounts 6,000(To reverse write-off of account) Cash Accounts Receivable6,000 (To record collection of account) 6,000\begin{array}{lrr} \text { Accounts Receivable} &1,500,000\\ \text {Sales Revenue } &&1,500,000\\ \text {(To record credit sales) } &\\\\ \text { Sales Returns and Allowances } &50,000\\ \text { Accounts Receivable} &&50,000\\ \text { (To record credits to customers) } &\\\\ \text { Cash } &1,250,000\\ \text { Accounts Receivable} &&1,250,000\\ \text { (To record collection of receivables)} &\\\\ \text { Allowance for Doubtful Accounts. } &36,000\\ \text {Accounts Receivable } &&36,000\\ \text { (To write off specific accounts) } &\\\\ \text { Accounts Receivable} &6,000\\ \text { Allowance for Doubtful Accounts } &&6,000\\ \text {(To reverse write-off of account) } &\\\\ \text {Cash } &\\ \text { Accounts Receivable} &6,000\\ \text { (To record collection of account) } &&6,000\\\end{array} Accounts ReceivableSales Revenue (To record credit sales) Sales Returns and Allowances Accounts Receivable (To record credits to customers) Cash Accounts Receivable (To record collection of receivables) Allowance for Doubtful Accounts. Accounts Receivable (To write off specific accounts) Accounts Receivable Allowance for Doubtful Accounts (To reverse write-off of account) Cash Accounts Receivable (To record collection of account) 1,500,00050,0001,250,00036,0006,0006,0001,500,00050,0001,250,00036,0006,0006,000

Learning Objectives

- Understand the process of accounting for bad debt expense and recognize the influence of write-offs on the cash realizable value of accounts receivable.

- Compute and comprehend the effect of bad debt expense through percentage estimates derived from net credit sales or balances of accounts receivable.

Related questions

At December 31, 2016, Wynne Company Reported Accounts Receivable of ...

Megan's Products Is Undecided About Which Base to Use in ...

Compute Bad Debt Expense Based on the Following Information ...

A Company Has $90,000 in Outstanding Accounts Receivable and It ...

On December 31 of the Current Year,the Unadjusted Trial Balance ...