Asked by Claire Layug on May 05, 2024

Verified

The Felton and Burchell Partnership has partner capital account balances as follows: Felton, Capital $550,000 Burchell, Capital 200,000\begin{array}{lr}\text { Felton, Capital } & \$ 550,000 \\\text { Burchell, Capital } & 200,000\end{array} Felton, Capital Burchell, Capital $550,000200,000

The partners share income and losses in the ratio of 60% to Felton and 40% to Burchell.

Instructions

Prepare the journal entry on the books of the partnership to record the admission of Santos as a new partner under the following three independent circumstances.

1. Santos pays $400000 to Felton and $150000 to Burchell for one-half of each of their ownership interest in a personal transaction.

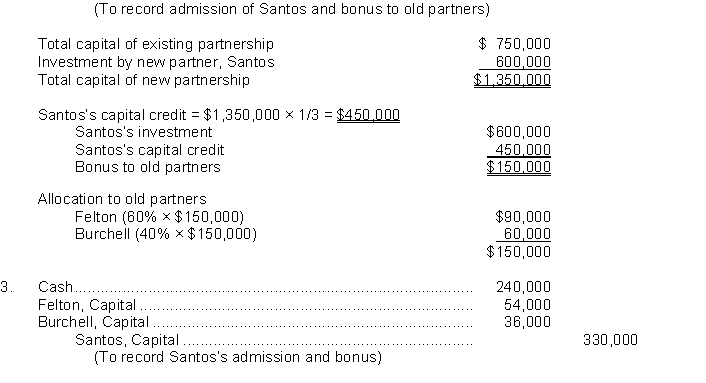

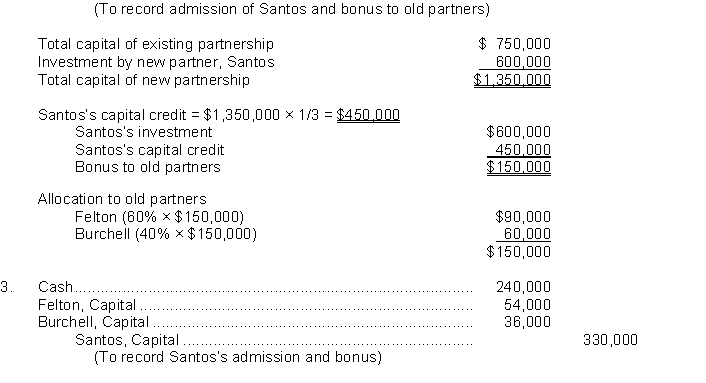

2. Santos invests $600000 in the partnership for a one-third interest in partnership capital.

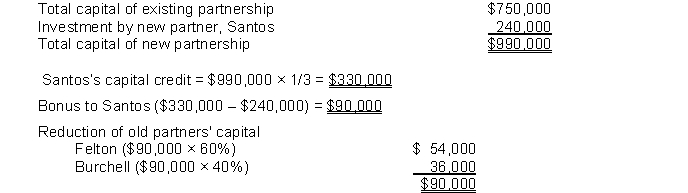

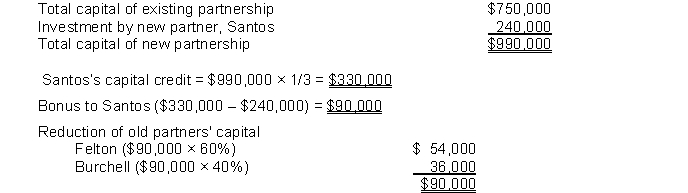

3. Santos invests $240000 in the partnership for a one-third interest in partnership capital.

Partner Admission

The process by which a new partner is accepted into a partnership, often involving the purchase or contribution of capital into the partnership.

Ownership Interest

The legal rights and claims a person has in a company or property, often expressed as a percentage of ownership.

Capital Account Balances

The amount in the capital accounts of a business or an individual, representing ownership interest or invested capital.

- Learn the techniques for welcoming a new partner into an already formed partnership and understand the financial ramifications of such a move.

Verified Answer

OW

Oliver WoottenMay 10, 2024

Final Answer :

1. Felton, Capital275,000 Burchell Capital 100,000Santos, Capital 375,000(To record admission of Santos by purchase) \begin{array}{llr} \text { Felton, Capital} &275,000\\ \text { Burchell Capital } &100,000\\ \text {Santos, Capital } &&375,000\\\text {(To record admission of Santos by purchase) } &\end{array} Felton, Capital Burchell Capital Santos, Capital (To record admission of Santos by purchase) 275,000100,000375,000

Total net assets and total capital of the partnership do not change.

2.

Cash 600,000 Felton, Capital90,000 Burchell, Capital 60,000Santos, Capital 450,000\begin{array}{llr} \text { Cash } &600,000\\ \text { Felton, Capital} &&90,000\\ \text { Burchell, Capital } &&60,000\\ \text {Santos, Capital } &&450,000\end{array} Cash Felton, Capital Burchell, Capital Santos, Capital 600,00090,00060,000450,000

Total net assets and total capital of the partnership do not change.

2.

Cash 600,000 Felton, Capital90,000 Burchell, Capital 60,000Santos, Capital 450,000\begin{array}{llr} \text { Cash } &600,000\\ \text { Felton, Capital} &&90,000\\ \text { Burchell, Capital } &&60,000\\ \text {Santos, Capital } &&450,000\end{array} Cash Felton, Capital Burchell, Capital Santos, Capital 600,00090,00060,000450,000

Learning Objectives

- Learn the techniques for welcoming a new partner into an already formed partnership and understand the financial ramifications of such a move.