Asked by Ysobelle Eustaquio on Jun 17, 2024

Verified

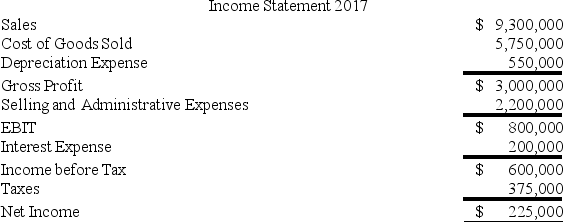

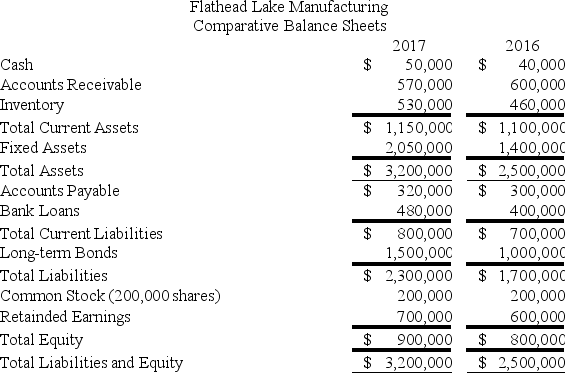

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt-to-equity ratio for 2017 is ________.

A) 2.13

B) 2.44

C) 2.56

D) 2.89

Debt-To-Equity Ratio

A financial metric that shows the comparative amount of equity and debt a company utilizes to fund its assets.

Financial Statements

Financial statements are formal records of the financial activities and position of a business, person, or other entity, typically comprising the balance sheet, income statement, and cash flow statement.

- Compute and explain financial ratios such as liquidity, leverage, and profitability indicators.

Verified Answer

Learning Objectives

- Compute and explain financial ratios such as liquidity, leverage, and profitability indicators.

Related questions

The Financial Statements of Flathead Lake Manufacturing Company Are Shown ...

Which One of the Following Ratios Is Used to Calculate ...

The Financial Statements of Flathead Lake Manufacturing Company Are Shown ...

The Average Number of Times a Company's Inventory Is Sold ...

Company G Has a Ratio of Liabilities to Stockholders' Equity ...