Asked by Kawinthida Kanajoth on Jun 07, 2024

Verified

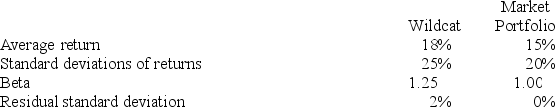

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Treynor's measure of performance for Wildcat Fund.

A) 0.01

B) 0.088

C) 0.44

D) 0.50

E) 0.61

Treynor's Measure

A performance metric for determining how well an investment compensates the investor for taking a risk, considering the risk-free rate.

Risk-Free Return

The theoretical return on an investment with no risk of financial loss.

Wildcat Fund

A type of investment fund that takes on high-risk investments, hoping for significantly higher-than-average returns.

- Learn about the range of measures for gauging performance (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and how they are determined.

- Recognize the value of risk-free returns in the analysis of investment performance.

Verified Answer

ZK

Learning Objectives

- Learn about the range of measures for gauging performance (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and how they are determined.

- Recognize the value of risk-free returns in the analysis of investment performance.

Related questions

You Want to Evaluate Three Mutual Funds Using the Sharpe ...

You Want to Evaluate Three Mutual Funds Using the Treynor ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...